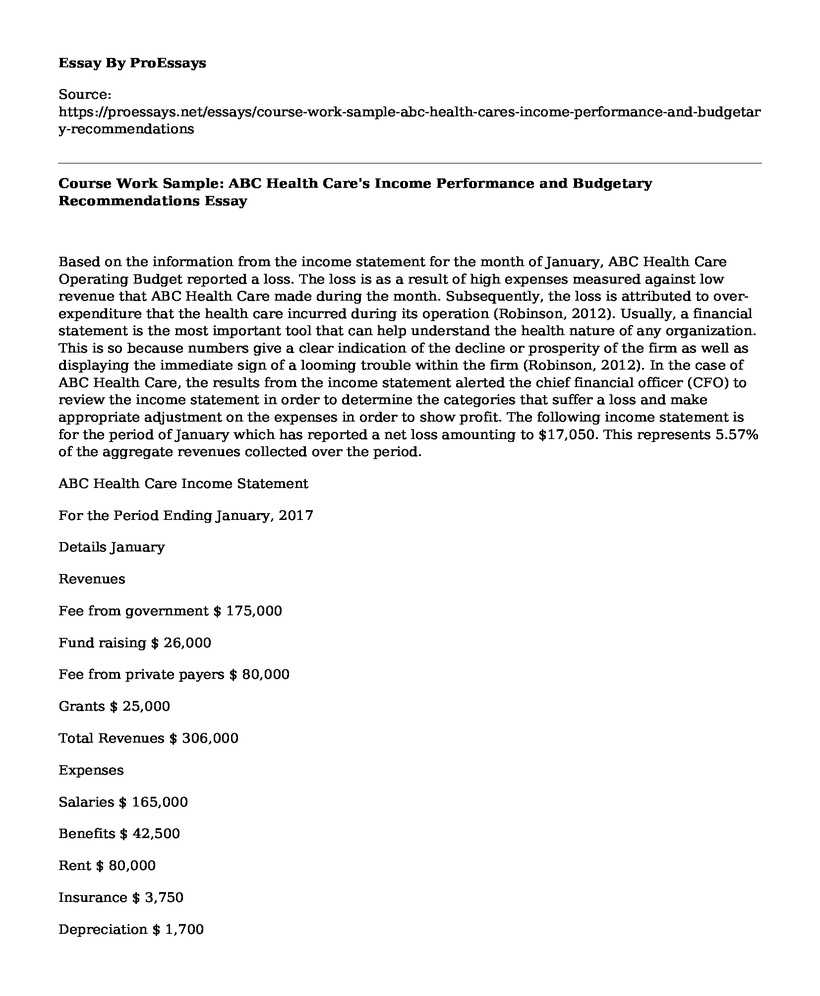

Based on the information from the income statement for the month of January, ABC Health Care Operating Budget reported a loss. The loss is as a result of high expenses measured against low revenue that ABC Health Care made during the month. Subsequently, the loss is attributed to over-expenditure that the health care incurred during its operation (Robinson, 2012). Usually, a financial statement is the most important tool that can help understand the health nature of any organization. This is so because numbers give a clear indication of the decline or prosperity of the firm as well as displaying the immediate sign of a looming trouble within the firm (Robinson, 2012). In the case of ABC Health Care, the results from the income statement alerted the chief financial officer (CFO) to review the income statement in order to determine the categories that suffer a loss and make appropriate adjustment on the expenses in order to show profit. The following income statement is for the period of January which has reported a net loss amounting to $17,050. This represents 5.57% of the aggregate revenues collected over the period.

ABC Health Care Income Statement

For the Period Ending January, 2017

Details January

Revenues

Fee from government $ 175,000

Fund raising $ 26,000

Fee from private payers $ 80,000

Grants $ 25,000

Total Revenues $ 306,000

Expenses

Salaries $ 165,000

Benefits $ 42,500

Rent $ 80,000

Insurance $ 3,750

Depreciation $ 1,700

Overhead $ 18,000

Supplies $ 4,500

Utilities $ 7,600

Total Expenses $ 323,050

Net Income (Loss) $ (17,050)

Monthly Revenues and Expenses that need to be adjusted

Looking at the current income performance, several revenues require to be adjusted. The facility should increase the revenues collected from private and government reimbursement fees by 10% of the current. This implies that the next budget should have fee collected from government for reimbursement services to $192,500 while amount from private payers should be $88,000. These adjustments are necessary as they increase the total revenues collected by the organization to $331,500, thus ensuring a net profit of $8,450 for the following month.

However, the adjustments have a tremendous effect on the firm. An increase in the revenue base implies that the firm will require expanding its services to another potential customer base, although this requires increasing the number of its staff (Robinson, 2012). It is likely, therefore, that the salary expenses will increase. In order to remain within a profitable range, the firm should increase its salary expenses by 2%, implying that the budgeted salary for the following month would be $168,300. This adjustment brings down the net profit to $5,150. However, the firm is still eligible of acquiring a higher profit than this by cutting its overhead expenses down by 3%. This implies that the budget for the following period should have overhead charge amounting to $17,460, thereby bringing the net profit to $5, 690.

For ABC Health Care to receive more reimbursement form the government, it must provide comprehensive medical service coverage to the public. This means that the hospital should perform more surgeries and so on. These additional services call for extra input of money and personal which are costly to meet.

Salary expenses are fixed for the firm, and it is often difficult to effect a downward adjustment. However, overhead expenses are variable and can be easily adjusted. The remaining expenses are hard to be adjusted and therefore, they may not be helpful in enabling the firm meet its objective of increasing its profit.

Adjusting salary expenses upwards has a systematic effect of increasing the revenues collected for the firm, which is vital towards ensuring profitability. Reducing overheads helps the firm cut on unnecessary expenses, thereby remaining with acceptable limits of its profitability, rather than experiencing a loss (Nikolai, Bazley & Jones, 2010). Table 2 below exhibits the profitable income statement for the firm, as budgeted for the following month.

Table 2

ABC Health Care Adjusted Budget For the Period of February, 2017

Revenues February

Fee from government $ 192,500

Fund raising $ 26,000

Fee from private payers $ 88,000

Grants $ 25,000

Total Revenues $ 331,500

Expenses

Salaries $ 168,300

Benefits $ 42,500

Rent $ 80,000

Insurance $ 3,750

Depreciation $ 1,700

Overhead $ 17,460

Supplies $ 4,500

Utilities $ 7,600

Total Expenses $ 325,810

Net Income (Loss) $ 5,690

Budgetary Recommendations

The recommendations analyzed in this case and presented on Table 2 above are aimed at making profit for ABC Health Care. As explained earlier, the firm needs a slight change on its expenses and revenue areas to ensure that it is profitable. Previous operations appear to have exhibited inefficiencies in the system, thereby increasing unnecessary expenses. Further, the firm might have underutilized or understaffed its operations, thereby hindering its objectives of attaining maximum revenues, hence profitability (Nikolai, Bazley & Jones, 2010). However, with the current adjustment, the firm is likely to run profitable by increasing 10% of both revenues collected from government and private payers while decreasing 2% of its overheads and increasing 3% of its salary expenses to expand its revenue base and lower unnecessary expenditures.

Finally, the adjustments are ethically sound considering that achieving higher revenues come handy with increase in expenses. This is the reason there needed to be a direct increase in salary expenses. Further, profitability is attained when there is efficient utilization of resources especially in operation (Nikolai, Bazley & Jones, 2010). Overhead expenses are variable and can be easily adjusted with proper management of resources especially in short-term. Hence, the adjustments are sound and achievable. The main ethical question that is bound to arise in these adjustments is the remuneration of additional staff. The amount reserved for paying salaries in the company before the adjustment is $165000. In order to reduce the net loss of the company from $17050 to $5690, it is recommended that it must input a further $3350 in salaries. This additional money is obviously not sufficient to pay the extra staff that will utilize their skills in the production process. Therefore, the salaries must be readjusted to incorporate every member of the staff. Consequently, the salaries of existing employees must be cut to accommodate the new staff. This action is likely to cause conflicts in the employees which might lead to go-slows, boycotts, and low work motivation. To handle this possible problem, the companys administration should explain the need to increase the staff and its consequences to all employees. ABC Health Care should promise all employees the reinstatement of their former remuneration once the company stands back on its feet.

References

Nikolai, L., Bazley, J. & Jones, J. (2010). Intermediate accounting. Australia Mason, OH: South-Western/Cengage Learning.

Robinson, T. (2012). International financial statement analysis. Hoboken, N.J: John Wiley & Sons.

Cite this page

Course Work Sample: ABC Health Care's Income Performance and Budgetary Recommendations. (2021, Apr 05). Retrieved from https://proessays.net/essays/course-work-sample-abc-health-cares-income-performance-and-budgetary-recommendations

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Nursing Theorists Annotated Bibliography

- Iron Deficiency Anemia and Folate Deficiency Anemia Essay

- Competitive and Economic Sustainability of Beautonomy Paper Example

- Essay Sample on Management of the Centre for Diseases Control Organization (CDC)

- Disaster Management in the City of Lufkin

- Paper Example on Walmart's Global Success: Brand Recognition, Expansion & Low Prices

- New Grad Nurses: Challenges & Solutions in Healthcare Transition - Research Paper