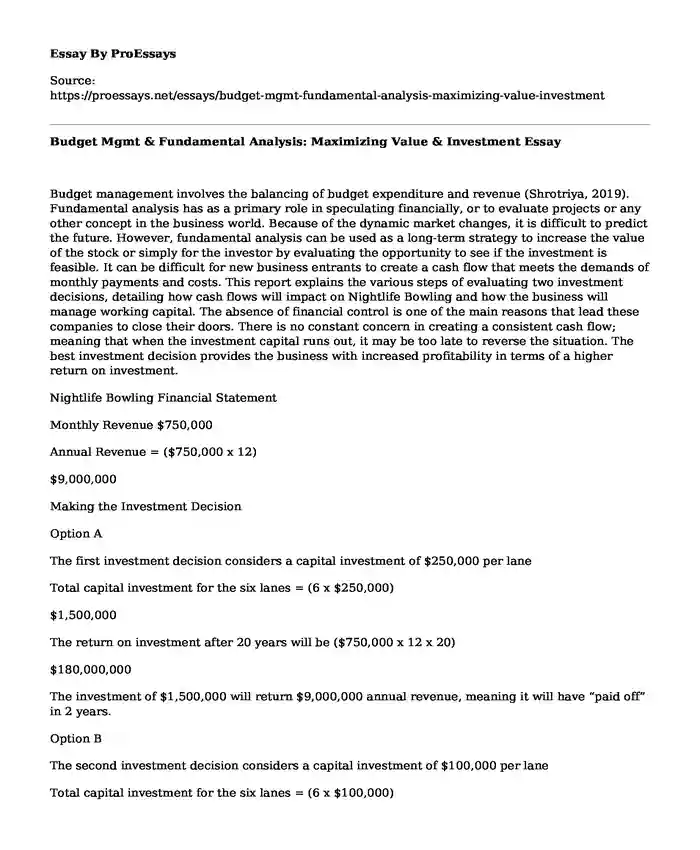

Budget management involves the balancing of budget expenditure and revenue (Shrotriya, 2019). Fundamental analysis has as a primary role in speculating financially, or to evaluate projects or any other concept in the business world. Because of the dynamic market changes, it is difficult to predict the future. However, fundamental analysis can be used as a long-term strategy to increase the value of the stock or simply for the investor by evaluating the opportunity to see if the investment is feasible. It can be difficult for new business entrants to create a cash flow that meets the demands of monthly payments and costs. This report explains the various steps of evaluating two investment decisions, detailing how cash flows will impact on Nightlife Bowling and how the business will manage working capital. The absence of financial control is one of the main reasons that lead these companies to close their doors. There is no constant concern in creating a consistent cash flow; meaning that when the investment capital runs out, it may be too late to reverse the situation. The best investment decision provides the business with increased profitability in terms of a higher return on investment.

Nightlife Bowling Financial Statement

Monthly Revenue $750,000

Annual Revenue = ($750,000 x 12)

$9,000,000

Making the Investment Decision

Option A

The first investment decision considers a capital investment of $250,000 per lane

Total capital investment for the six lanes = (6 x $250,000)

$1,500,000

The return on investment after 20 years will be ($750,000 x 12 x 20)

$180,000,000

The investment of $1,500,000 will return $9,000,000 annual revenue, meaning it will have "paid off" in 2 years.

Option B

The second investment decision considers a capital investment of $100,000 per lane

Total capital investment for the six lanes = (6 x $100,000)

$600,000

The return on investment after 20 years will be ($750,000 x 12 x 20)

$180,000,000

The investment of $600,000 will return $9,000,000 annual revenue, meaning it will have "paid off" in the first month.

The best investment decision is, therefore, updating the bowling lanes with BowlTech 2100 package at $100,000 per lane, since the investment will pay off within a month compared to 2 years if new Starlight Lanes equipment was purchased and installed.

The Impact of Investment Decision on Cash Flow

Cash flow refers to all the internal movement of money and what it produces in a company during a certain period (Sari & Leon, 2020). Managing cash flow can lead to the business not only being stable but also showing constant growth. Cash flow can help manage the payments of a company, investments, and suppliers, meaning that proper administration will help the business have effective financial management.

There are various fundamental ways of managing cash flow (Fehrenbacher et al., 2020):

Analyzing the cash flow: analyzing means understanding how the business can create cash and also what can cause it to increase or decrease. Knowing the nature of the cash flow will help in making conscious decisions about how to manage it properly.

Controlling the cash flow: Cash flow is important for the short-term stability of the business since it can pay the company's payroll, as well as allow negotiating with suppliers and even making investments. Therefore, it is important that, after analyzing the cash flow, the company have greater control through its expenses and income.

Creating greater cash flow: If the cash flow is controlled and it presents a growth according to the sales, then the company must work to create more cash flow. This can be done through controlling expenses, but also through investing in sales strategies such as investing in marketing or training for sales personnel. The objective would be to achieve higher sales which equal higher cash flow.

Avoiding debt and leveraging the business: one of the most important decisions is when entrepreneurs use debt for their benefit. Getting into debt leads to the creation of future cash flow problems, preventing the ability to pay the debt. The fact of leveraging is that the company can create more income and through this income, it can better manage its cash flow since it will have greater availability.

Monitoring accounts receivable: When a sale is made, the sale amount can be paid at the moment or be put in accounts receivable. Accounts receivable do not create cash for the business unless they are paid, so it is important that the company has a clear collection policy and that the buyers are familiar with it so they can also prepare to pay. Establishing the payment periods ensures that clients do not have a pretext when it comes to paying off their debt, as well as the penalties that will occur if they do not pay on time. Corporate clients must be made to sign a contract so that the parties agree to what is established.

Good cash flow will allow the company to determine the surpluses or shortfalls of money for a period, to know how to invest the surpluses or request financing for the shortfalls. Also, the business can identify the behavior of the flow of money in inflows, outflows, or financing by maintaining control. Likewise, it will be able to evaluate the collection and payment policies and, if applicable, suggest to the management to correct them based on the final result of the cash flow.

It is recommended to always keep the documentation up to date, as it will be the source of information to feed the cash flow and payments. It must be verified if the price of the product or service is consistent with what the market dictates in practice. The cash flow must also be implemented and used for company decision making. Also, specialized staff is essential. In the case of Nightlife Bowling, having trained professionals, or hiring specialized advice is a good measure to control cash flow.

Managing Working Capital

Working capital refers to the investment that a company has in goods and rights represented by cash, accounts receivable, and merchandise inventory (Khalid et al., 2018). Most of the research carried out on this matter indicates that financial managers dedicate most of their time to the day-to-day operations of the company, that is, to the management of current assets and liabilities.

The financial statements of most companies show that more than half the value of total assets corresponds to investment in current assets (cash, accounts receivable, and inventories). This is particularly valid in micro and small companies, since, as their resources are more limited, they prefer to rent the plant and equipment, which is part of the fixed asset. This income option cannot be applied to current assets values. Similarly, since micro and small companies have limited access to sources of long-term financing, they are forced to finance themselves with commercial credits and short-term bank loans. This affects net working capital by increasing short-term debts.

The primary purpose of cash and bank management is to be able to make timely decisions about assets that influence accounts receivable and payable, causing profit or loss. The more effective the collection of accounts receivable, the greater the possibility of requesting or paying debts, avoiding the payment of financial expenses such as interest, and reducing its costs (Sari et al., 2020). Also, financial resources may be required for the expansion of the company. One of the cash management strategies refers to the dimensioning of the operating cycle and the financial cycle, also called the cash cycle.

For Nightlife Bowling, the operating cycle corresponds to the period elapsed from the arrival of the bowling lanes to the receipt of the money from the sale of bowling services. The cash cycle, on the other hand, corresponds to the period between the cash outflow, generally considered for suppliers, and the receipt caused by sales.

The main problems of working capital are mainly due to the decrease in sales, the increase in delinquencies of customers, the increase in financial expenses and costs. As in the treatment of many other problems, preventive action plays an important role in solving working capital problems.

Nightlife Bowling anticipates its primary revenue to come from renting its bowling facility to local corporations for company outings and team-building events. This payment policy has a "domino effect" generated by the delay in payments for services rendered, for example, which directly impacts cash flow. For effective cash flow management, the company must obtain financial malleability that allows it to adjust payments and control cash flow.

Maintaining control over this money is essential because it is the engine that gives life to the business and it is what drives it day by day because, in a strict sense, the main purpose of a business is to generate money and move it from different ways. One of the definitive solutions to solve the problems of working capital is to recover profitability and, consequently, reactivate cash flow (Khalid et al., 2018). This requires comprehensive strategic measures, which can be from the launch of new items or services, new means of sale, or even the reprogramming of the business in its entirety. Some of the strategies the company can use to obtain financial malleability include (Ke, 2017; Sari et al., 2020):

Projecting all collections and payments for the next 12 months, taking into account issues such as the seasonality of the product or service, non-compliance, staff turnover, and taxes such as rates, real estate, insurance, etc.

Analyzing weekly the numbers "done versus projected", to take corrective actions, if necessary.

In the projections, creating different scenarios, considering less charges or extra payments, to see how the final cash balance behaves.

Keeping the cash flow always updated.

On average, the working capital represents a large portion of the total assets of a company. Proper management of these assets requires a large amount of effort, time dedication, good knowledge, and experience on the part of the administration. Additionally, it needs constant monitoring, since it may be continuously suffering the impact of the different changes facing the company.

References

Fehrenbacher, D. D., Kaplan, S. E., & Moulang, C. (2020). The role of accountability in reducing the impact of affective reactions on capital budgeting decisions. Management Accounting Research, 47, 100650. https://doi.org/10.1016/j.mar.2019.100650Ke, X. (2017). The Impacts of the CPS, Free Cash Flow, Tobin's Q, and Price-Earnings Ratio on Investment Decisions. Free Cash Flow, Tobin's Q, and Price-Earnings Ratio on Investment Decisions (April 23, 2017). https://dx.doi.org/10.2139/ssrn.2957267Khalid, R., Saif, T., Gondal, A. R., & Sarfraz, H. (2018). Working capital management and profitability. Mediterranean Journal of Basic and Applied Sciences (MJBAS), 2(2), 117-125.

Sari, W. R., & Leon, F. M. (2020). The influence of investment-cash flow sensitivity and financially constrained on investment. Jurnal Keuangan dan Perbankan, 24(1), 30-39. https://doi.org/10.26905/jkdp.v24i1.3475Shrotriya, D. V. (2019). Risk Analysis in Capital Budgeting.

Cite this page

Budget Mgmt & Fundamental Analysis: Maximizing Value & Investment. (2023, Oct 13). Retrieved from https://proessays.net/essays/budget-mgmt-fundamental-analysis-maximizing-value-investment

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Can Positive Psychology Make You Happier? - Essay Sample

- Hungary April 2018 Elections and Viktor Orban Essay

- Definitions of Deviance in the Media Essay

- The High-Level Depression Patient - Case Study

- Contemporary Housing Under UK's Conservative Government's New Housing and Welfare Policies

- Essay Example on Carmen Maria Machado: Exploring Women's Cognitive Dysphoria

- Nurses: Enhancing Workplace Safety & Civility for High-Perf Teams