Introduction

In economics, fiscal policy refers to the mechanisms by which a government adjusts it taxes and its spending to expand or contract its economy. In this case, the government applies fiscal policy tools which include taxes and governments spending. Taxes act as the main tool used by the government to adjust its economy, and it involves collecting money from the public through sales taxes, income taxes, VAT, and other indirect taxes. Another tool used is government spending whereby the government uses its revenue to manage projects that benefit the public. Such tools have been used by the government of Hungary to stabilize its economy.

Applications of Fiscal Policy Tools

The two primary fiscal policy tools are applied in Hungary to boost the country's economy. Firstly, taxation in the country is imposed both at the national and local governments. Reports show that about 40% its GDP came from taxation revenue. At the national level, the major taxation revenue sources include income tax, corporate tax, social security tax, and value added tax. In 2018, the taxation rates in the country have been reduced as the government is trying to make sure that its citizens do not suffer from heavy taxes. Secondly, the government of Hungary has increased since 2017. In the last quarter of 2017, the government spent about 784100 HUF Million (Cordes, 2015). Although the spending reduced to 643570 in the first quarter of 2018, the expenditure increased to 691096 in the second semester. The increase in government spending is aimed to improve the lives of citizens in the country.

Government Statistics on the Budget Balance and EU Requirements for Member Countries

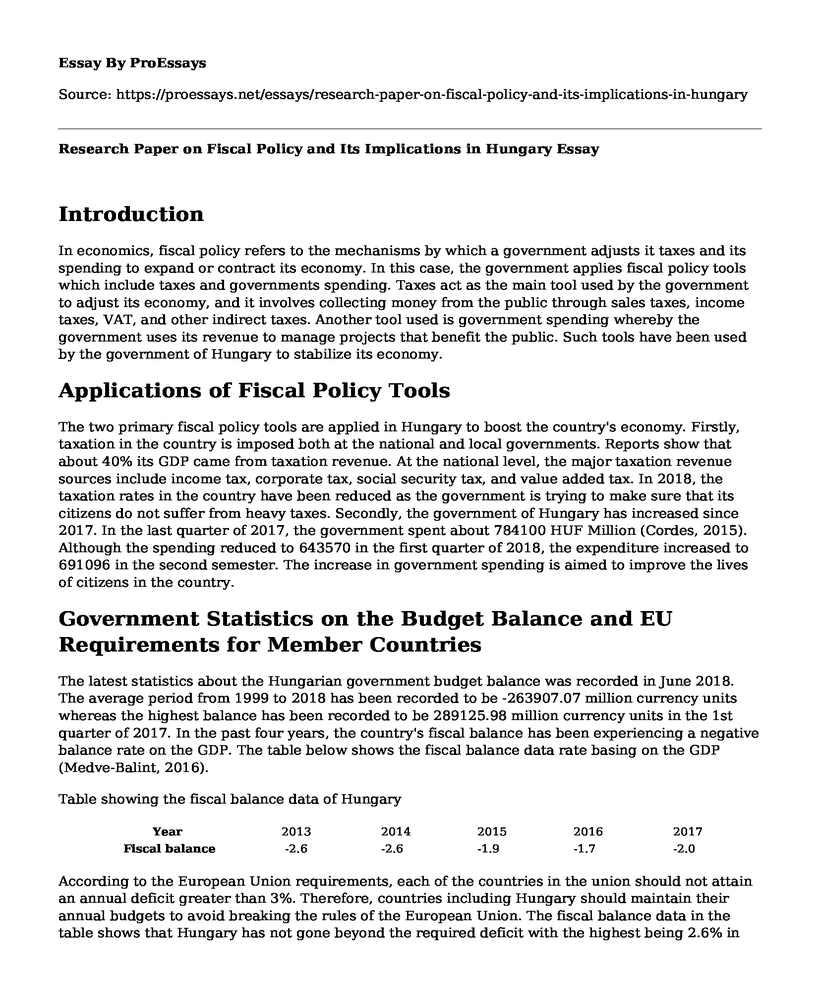

The latest statistics about the Hungarian government budget balance was recorded in June 2018. The average period from 1999 to 2018 has been recorded to be -263907.07 million currency units whereas the highest balance has been recorded to be 289125.98 million currency units in the 1st quarter of 2017. In the past four years, the country's fiscal balance has been experiencing a negative balance rate on the GDP. The table below shows the fiscal balance data rate basing on the GDP (Medve-Balint, 2016).

Table showing the fiscal balance data of Hungary

| Year | 2013 | 2014 | 2015 | 2016 | 2017 |

| Fiscal balance | -2.6 | -2.6 | -1.9 | -1.7 | -2.0 |

According to the European Union requirements, each of the countries in the union should not attain an annual deficit greater than 3%. Therefore, countries including Hungary should maintain their annual budgets to avoid breaking the rules of the European Union. The fiscal balance data in the table shows that Hungary has not gone beyond the required deficit with the highest being 2.6% in 2013 and 2014.

EU Budget and Sources of Financing and Outlets for the Funds' Use

The European Union has an annual budget which entails the total income that should be spent by EU economies each year. According to the 2018 figures, the union is supposed to spend up to about 160.1 billion euros in all its commitments (Cipriani, 2014). The larges sums of money used by the union in its annual budgeting come from several sources which include import duties on products from countries outside EU, contributions from member countries, and fines on business countries that violate the EU rules among others. Most importantly, the country uses the funds included in its budget for important functions. Such outlets include humanitarian aids, research, and regional and urban development among others.

Differences between the US Fiscal Policy and EU Members Fiscal Policy

The differences between the fiscal policies of the US and the European Union countries have made it possible for the two states to depend on each other in developing their economies. Firstly, the US federal spending has confirmed to be favorable to the economy of the involved states such that there has been no reported economic shock. The reason behind this is that taxation and government spending in these is continuous unlike in EU member countries where the tools keep on shifting each year. Secondly, the degree of tax collection varies between the two states. In the US, tax collection of about 14 to 20% of the GDP has been collected for the past 50 years while in the EU member countries only tax collection of 1% of the GDP is collected annually (Nugent, 2017). Therefore, the US level of tax collection is high enough to finance all the involved states.

Conclusion: Fiscal Policy as Economic Stabilization Mechanism

Having analyzed the fiscal policy in EU member countries, specifically Hungary, it is clear that fiscal policy tools can help a country stabilize its economy. Tax collection when done progressively can enable the country to get enough capital to spending on projects that benefit the public. As such, EU member countries should adopt some of the approaches in the US fiscal policy to improve its outcome in stabilizing their economies.

References

Cipriani, G. (2014). Financing the EU Budget: Moving forward or backwards? CEPS Paperback.

Cordes, T., Kinda, M. T., Muthoora, M. P. S., & Weber, A. (2015). Expenditure rules: effective tools for sound fiscal policy? (No. 15-29). International Monetary Fund.

Medve-Balint, G., & Bohle, D. (2016). Local Government Debt and EU Funds in the Eastern Member States: The Cases of Hungary and Poland.

Nugent, N. (2017). The government and politics of the European Union. Palgrave.

Cite this page

Research Paper on Fiscal Policy and Its Implications in Hungary. (2022, Oct 18). Retrieved from https://proessays.net/essays/research-paper-on-fiscal-policy-and-its-implications-in-hungary

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Government Resolution to Market Failure Considering Core Values of Community and Dignity

- Challenges of Policing in a Democratic Society Essay

- Miracle Works Agency Client System Analysis Paper Example

- The Nuclear Arms Race - Essay Sample

- Annotated Bibliography on Mexican Drug Cartels: Thriving Despite Security Measures

- Essay Example on John's Downward Spiral: Loss of Employment and Social Needs

- Paper Sample on Technology Destroys More Jobs Than It Creates