Introduction

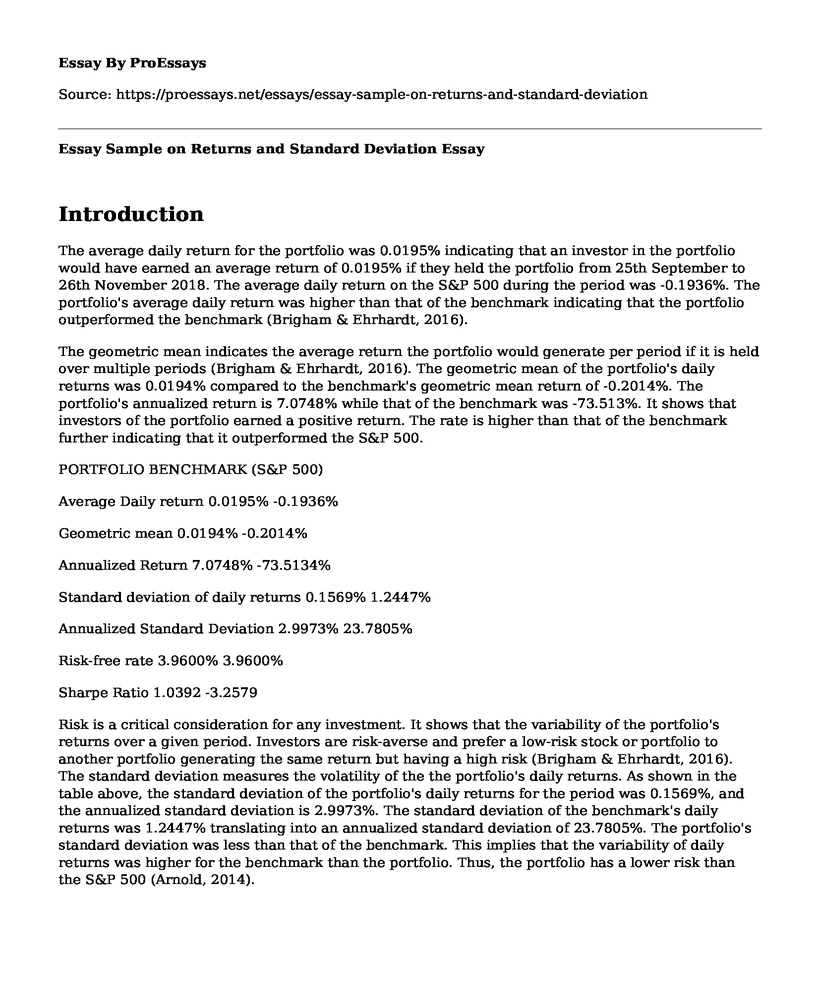

The average daily return for the portfolio was 0.0195% indicating that an investor in the portfolio would have earned an average return of 0.0195% if they held the portfolio from 25th September to 26th November 2018. The average daily return on the S&P 500 during the period was -0.1936%. The portfolio's average daily return was higher than that of the benchmark indicating that the portfolio outperformed the benchmark (Brigham & Ehrhardt, 2016).

The geometric mean indicates the average return the portfolio would generate per period if it is held over multiple periods (Brigham & Ehrhardt, 2016). The geometric mean of the portfolio's daily returns was 0.0194% compared to the benchmark's geometric mean return of -0.2014%. The portfolio's annualized return is 7.0748% while that of the benchmark was -73.513%. It shows that investors of the portfolio earned a positive return. The rate is higher than that of the benchmark further indicating that it outperformed the S&P 500.

PORTFOLIO BENCHMARK (S&P 500)

Average Daily return 0.0195% -0.1936%

Geometric mean 0.0194% -0.2014%

Annualized Return 7.0748% -73.5134%

Standard deviation of daily returns 0.1569% 1.2447%

Annualized Standard Deviation 2.9973% 23.7805%

Risk-free rate 3.9600% 3.9600%

Sharpe Ratio 1.0392 -3.2579

Risk is a critical consideration for any investment. It shows that the variability of the portfolio's returns over a given period. Investors are risk-averse and prefer a low-risk stock or portfolio to another portfolio generating the same return but having a high risk (Brigham & Ehrhardt, 2016). The standard deviation measures the volatility of the the portfolio's daily returns. As shown in the table above, the standard deviation of the portfolio's daily returns for the period was 0.1569%, and the annualized standard deviation is 2.9973%. The standard deviation of the benchmark's daily returns was 1.2447% translating into an annualized standard deviation of 23.7805%. The portfolio's standard deviation was less than that of the benchmark. This implies that the variability of daily returns was higher for the benchmark than the portfolio. Thus, the portfolio has a lower risk than the S&P 500 (Arnold, 2014).

Sharpe Ratio

The goal of any investor is to maximize returns while minimizing the risk associated with an investment. A trade-off exists between risk and return hence an investor must balance between the two. According to Arnold (2014), Sharpe ratio is a risk-adjusted performance metric for an investment. It shows the excess return an investment generates above the risk-free rate per unit of total risk (standard deviation). It helps indicates the driver of a portfolio's return, which is either excess risk or sound investment decisions (Brigham & Ehrhardt, 2016). A portfolio with a high Sharpe ratio is suitable because it indicates a greater risk-adjusted performance than an investment with a lower Sharpe ratio (Brigham & Ehrhardt, 2016).

As shown in the table above, the Sharpe ratio for the portfolio was 1.0392. The ratio is more than one indicating that the portfolio generated more excess returns for each unit of risk undertaken. The positive sign implies that the portfolio generated a higher return than the risk-free return. The Sharpe ratio for the S&P 500 was -3.2579 showing that its return was lower than the return an investor would earn on risk-free security. The portfolio's Sharpe ratio was higher than that of the S&P 500. It implies that the portfolio had a higher risk-adjusted performance than the benchmark.

Conclusion

The above analysis shows that the portfolio's average daily and annualized returns were higher than that of the benchmark. Besides, the volatility of the portfolio's returns was lower than that of the benchmark. Sharpe ratio analysis shows that the portfolio generated a higher risk-adjusted return than the benchmark. Therefore, the portfolio outperformed the benchmark in both return and risk. An investor who selects the portfolio would earn a higher return than the market average.

References

Arnold, G. (2014). Corporate Financial Management. Harlow, United Kingdom: Pearson Education Limited.

Brigham, E., & Ehrhardt, M. (2016). Financial Management: Theory & Practice (15th ed.). Cengage Learning.

Cite this page

Essay Sample on Returns and Standard Deviation. (2022, Nov 04). Retrieved from https://proessays.net/essays/essay-sample-on-returns-and-standard-deviation

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Dissertation Methodology on the Impact of Digital Marketing Reviews on Restaurant Reputation and Customer Behaviour

- The Budgeting and Financial Planning Approach for A2 Milk Company

- Kohls Financial Statement and Analysis

- Paper Example on TAM's Growth: From $1M to $25M in 2009 Under Jack's Management

- Essay Example on Smiling: A Key Ingredient in Personal & Professional Interactions

- Research Paper on Taxation: The Unavoidable Levy of Governments

- Essay Example on VW Group's Steady Rise in Revenue: 252 Billion Euros in 2019