Introduction

Patisserie Holdings PLC and its auxiliaries operate in the eateries segment in the UK and the Republic of Ireland. The organization's stores positions incorporate bistros and cafes, brasseries, takeaways, concessions, stands, and also an online platform. Its retail outlets offer pastries and cakes, meals, snacks, and both cold and hot beverages.

The organization runs 152 retail shops under the brand name Patisserie Valerie: twenty stops under the brand name Druckers - Vienna Patisserie, twenty-two shops under the brand name Philpotts, four shops under the brand Baker & Spice, and one bakery store under the brand name Flour Power City Bakery. Patisserie Holdings PLC was established in 1926 in Birmingham, United Kingdom.

To investors, Patisserie is a straightforward business to understand and therefore, it attracts so many people wanting to invest their money. It is also a high cash-generating business whose revenues and cash look real. It is very difficult to disguise cash.

Being a simple business, it is very easy to follow and keep track of its operations, be it daily or even over time. Besides, it looks like such a clean business. All these aspects of the business attract investors.

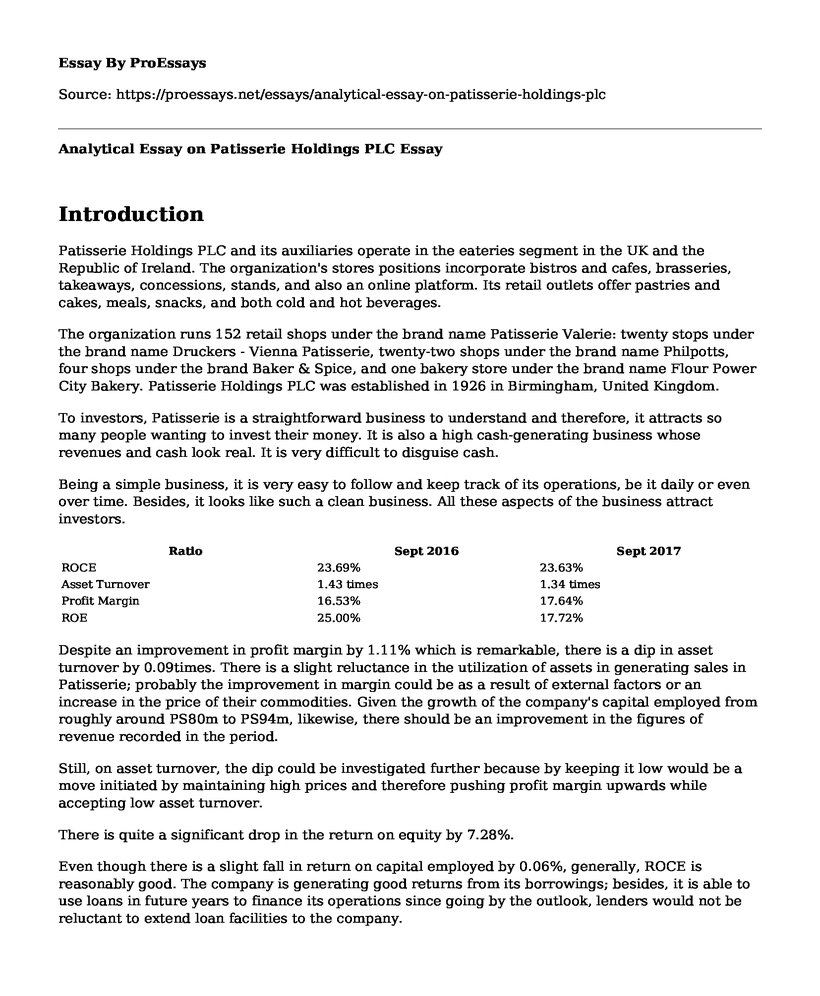

| Ratio | Sept 2016 | Sept 2017 |

| ROCE | 23.69% | 23.63% |

| Asset Turnover | 1.43 times | 1.34 times |

| Profit Margin | 16.53% | 17.64% |

| ROE | 25.00% | 17.72% |

Despite an improvement in profit margin by 1.11% which is remarkable, there is a dip in asset turnover by 0.09times. There is a slight reluctance in the utilization of assets in generating sales in Patisserie; probably the improvement in margin could be as a result of external factors or an increase in the price of their commodities. Given the growth of the company's capital employed from roughly around PS80m to PS94m, likewise, there should be an improvement in the figures of revenue recorded in the period.

Still, on asset turnover, the dip could be investigated further because by keeping it low would be a move initiated by maintaining high prices and therefore pushing profit margin upwards while accepting low asset turnover.

There is quite a significant drop in the return on equity by 7.28%.

Even though there is a slight fall in return on capital employed by 0.06%, generally, ROCE is reasonably good. The company is generating good returns from its borrowings; besides, it is able to use loans in future years to finance its operations since going by the outlook, lenders would not be reluctant to extend loan facilities to the company.

| Ratio | Sept 2016 | Sept 2017 |

| Gross profit margin | 16.53% | 17.64% |

| Net profit margin | 13.19% | 14.33% |

| Current ratio | 6.12 | 8.03 |

| Quick ratio | 5.15 | 6.87 |

Both the current and quick ratios express a healthy position, with an improvement as compared to the previous year's performance by 1.91 and 1.72 times respectively. This implies that Patisserie has sufficient current assets which give it the surety of being able to meet its future obligations to settle its current liabilities.

The increasing trend ascertains a favorable liquidity position. However, this should not be allowed to extend so much since that would imply that the company is investing excessively in working capital and thus, holding up a lot of finances within the business than is actually needed anyway.

Profit margins show improvement, with a plus of 1.11% and 1.14% for gross profit margin and net profit margin respectively. Likewise, there is notably some consistency in the operating expenses showing 3.34% and 3.31% in 2016 and 2017 respectively. This is very impressive. There is so much consistency here, probably the prices are fairly constant, and operations are running smoothly and efficiently.

| Ratio | Sept 2016 | Sept 2017 |

| Debt ratio | 5.95% | 5.22% |

| Gearing ratio | 0 | 0 |

| Interest cover | 2,868.33 times | 479.64 times |

The relationship between total assets and total debts is meager: almost next to no. There is no guide to the maximum safe debt ratio, but 50% could be a reasonable limit. However, in practice, there are many companies operating well despite, of course, a higher than 50% debt ratio.

Patisserie operates with zero gearing. Capital gearing relates to a company's capital structure in the long-term and measures the proportion of a company's capital which is debt. The operations of patisserie Holdings is not in any way financed by debt instruments.

The greater risk of a highly geared company is there will be little (if any) available for distribution in the form of a dividend to ordinary shareholders. This is because interest has to be paid annually on that debt.

Patisserie has more than sufficient interest cover: with interest cover of 2,868.33 times and 479.64 times in 2016 and 2017 respectively.

The company is realizing sufficient profits (profit before taxation and interest) to settle its interest costs (finance cost) effortlessly. Given Patisserie's zero gearing, this is not at all surprising.

We can obtain a picture of Patisserie does not have a debt problem.

| Ratio | Sept 2016 | Sept 2017 |

| Basic EPS | 0.1374p | 0.1636p |

| Dilutes EPS | 0.1360p | 0.1620p |

| P/E | 22.47 | 21.09 |

The earnings per share (EPS) is one of the most frequently quoted statistics in financial analysis. There is an improvement in EPS by 0.026p which is very positive. Compared to the diluted EPS figures in both years, there is minimal dilutive effect or 'watering down' of equity which is 0.0014p and 0.0016p in 2016 and 2017 respectively.

Due to the accounting black hole uncovered in that week of 12th October 2018, the position is likely to be different as a result of the move to issue shares to the public so as to raise finances to keep the company afloat.

There is a dip in the P/E ratio by 1.38 and which indicates a fall in shareholder confidence in the company and as well its future.

Though the values are favorable, the negative change in P/E is what is of importance because it speaks of reduced confidence in the market perception of investors and shareholders. Either they are uncertain about profit growth (profitability), probably foreseeing lower P/E ratios in subsequent periods, or even there could be some suspicion of possible malice or malpractices in the operations of the company which could be counter-productive.

The net asset value per share shows a steady improvement year after year: PS0.6040 in 2016 and PS0.7440 in 2017. This is an import factor for any investor or prospective acquirer to consider.

Other than ratio analysis other aspects can be assessed to enable investors to make informed economic decisions.

The group has scaled up from operating a humble 6retail shops to about 200retail outlets currently. This actually speaks of quite a hands-on team: management and staff. It cannot just be a corporate financing creation of acquisitions but of real organic growth: outlets opened up us a result of positive and steady cash flows.

The company has quite a slim board which comprises of three executives and two non-executives. However, the non-executive members are highly experienced and equal to the task of steering the company.

One of them is the former Domino Pizza's finance officer, and the other one was part of a very successful restaurant group. Therefore, with such industry specialists and experts, it is easy to infer that the leadership of the group is unquestionable.

Conclusion

Generally, Patisserie Holdings PLC remains very attractive for any investor though, a few issues need to be addressed such as properly utilizing the assets of the company to generate more sales and in turn maximize profits; there is also need to into the future in terms of shareholder value, because in this way share prices will improve more steadily and the company will become more and more attractive not only to investors but also to other stakeholders.

References

BPP Learning Media 2015, Acca f7 financial reporting, 8th edn, Bpp Learning Media, London.

London Stock Exchange 2019, Patisserie share price (cake), London Stock Exchange. Available from: https://www.londonstockexchange.com/exchange/prices-and-markets/stocks/summary/company-summary/GB00BM4NV504GBGBXAMSM.html. [2 January 2019].

Cite this page

Analytical Essay on Patisserie Holdings PLC. (2022, Nov 08). Retrieved from https://proessays.net/essays/analytical-essay-on-patisserie-holdings-plc

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Ordinary People Under Capitalism Essay

- Essay Example on Shareholder Rights & Privileges: Key to Stock Valuation

- Essay on Entrepreneurship: Key to Global Economic Development Post-2008 Crisis

- Essay Example on Consumer Protection: Safeguarding Public from Unfair Practices

- Essay Example on Experience the Magic of Olive Gardens: The Ultimate First Impression

- Paper Sample on Adapting to Change: Overcoming Challenges in the Business World

- Free Essay Sample on Ethical Compliance: Benefits for Companies and Society