Introduction

Australia is a well-known country worldwide due to its diverse population and its involvement in the world trade. Investors in the state engage in both local and international trade. In the international market, the country exports several goods including iron ore, gold, wheat, coal, and copper. Among this, iron is the top-earning export product for the country. Besides, the country exports several goods which are mainly machinery and transport equipment. Such goods include vehicles, industrial machines, and electrical appliances among others. As a state that takes part in local and international trade actively both locally and internationally, there are tax rates that are standardized on the exported goods which may change according to the fluctuations in the world market. However, the taxing rate in the counties has its procedures and steps that differ from those of other countries.

How Australian Company Taxes its Tax Rate

The Australian company tax rates have been varying since the introduction of the Australian dividend imputation system in 1987. Before that, it used the classical dividend taxation system which involved double taxation, at the company and the shareholder respectively. The new system removed the double taxation and also lowered the tax rate of the company. Since then, the company tax rate went through fluctuations in that it sometimes increased and decreased at other times (Kawano, 2016). However, the increased did not usually go beyond 40% as it used to be before the removal of double taxation. The highest increase was reported in 1995 where it rose from 33% to 36%. The highest decrease was reported in 2000 whereby it fell from 34% to 30%. From there, the tax rate remained flat with no great fluctuation until 2016 when small business entities entered the market with lower rates of 28.5%. In 2017-18 regimes, the Australian government declared the small business entities as base rate entities because they marked the lowest tax rates in Australian trade.

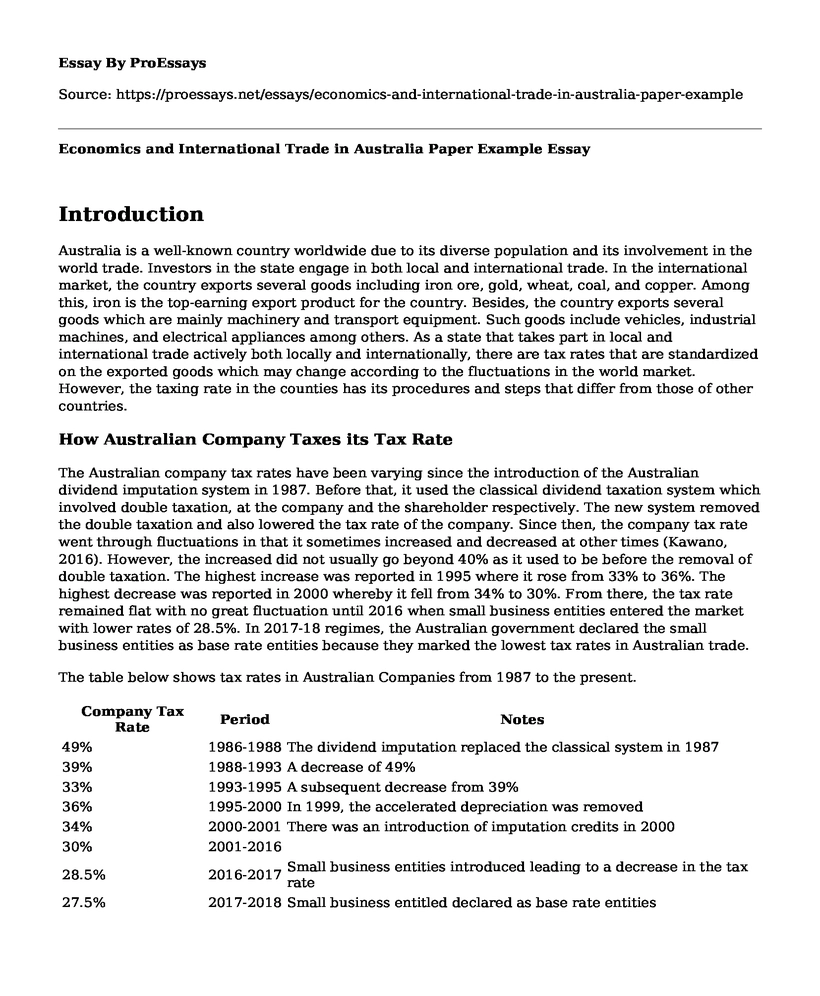

The table below shows tax rates in Australian Companies from 1987 to the present.

| Company Tax Rate | Period | Notes |

| 49% | 1986-1988 | The dividend imputation replaced the classical system in 1987 |

| 39% | 1988-1993 | A decrease of 49% |

| 33% | 1993-1995 | A subsequent decrease from 39% |

| 36% | 1995-2000 | In 1999, the accelerated depreciation was removed |

| 34% | 2000-2001 | There was an introduction of imputation credits in 2000 |

| 30% | 2001-2016 | |

| 28.5% | 2016-2017 | Small business entities introduced leading to a decrease in the tax rate |

| 27.5% | 2017-2018 | Small business entitled declared as base rate entities |

Calculation of Company Tax Rates in Australia

In Australia, taxation is dependent on the business organizations being handled. Company tax rate rates vary from small business taxation in that the rates levied towards big organizations are a bit higher than those of the lower organizations (Herault, 2015). In essence, the calculation of the tax rate of a company business structure is done as a separate legal entity, and it does its tax returns. Besides, there is no tax-free threshold for any company business structure in Australia.

Currently, the company tax rate in Australia is 30% while that of small business entities is 27.5%. As shown earlier, companies in Australia have to file yearly tax returns. The tax returns include the company's total income, all deductions, and the income the company is obliged to pay (Chardon, 2016). However, if the company has any associated mini-organizations, they will make their annual returns too. The salaries of the company's employee are also included in the annual returns of the company. Apart from the main tax rates put in place; other tax rates have been included in the Australian plans. They included the Financial Year 2017 (FY17) company tax rates, FY18 company tax rates, and future year company tax rates.

Firstly, the FY17 company tax rates were applicable for the 2016-17 financial year in that the lower tax rate was 27.5%. It was meant for businesses that have an average turnover of less than $10 million. If the business matured to over $10 million or above, the rate increased to 30%. Secondly, the FY12 company tax rates, which were applicable for the 20`1`7-18 financial year were meant for base rate entity companies. A 27.5% tax rate was applicable. A base rate entity, in this case, was defined as a company that has an average turnover of less than the turnover threshold. For the 2017-18 financial year, the amount for the base rate entity is $25 million. As in the case of the small entity business, if the base rate business turns above $25 million the tax increases to 30%. Lastly, the future year company tax rates have also been planned. The 27.5% is supposed to remain as from 2018-29 income year. However, the based rate entities turnover will rise to about $50 million.

Furthermore, there were prosed modifications to the tax laws in the year 2017. To begin with, in 18th October 2017 there was a proposal that there be a change in the definition of a base rate entity so that it can differ from that of 2017-18 income years. Business tests carried out previous would be change to 80% income tests. Also, on 11th May 2017, there was a proposal that the lower tax rates should be extended to all companies.

Comparison of the Australian Company Tax Rate with Other Countries

In the recent years, there were complaints about the high tax rate of Australian companies. They complainants aim was to see the tax rate reduce even by one percent. The government gave them hopes by promising a decrease of 1.5%. However, the decrease did not occur at all. For that matter, Australia has remained among the countries with the highest tax rate worldwide. In 2015, the CEO of the Australian Chamber of Commerce and Industry, Kate Carnell reported the high rates were making the country to be uncompetitive to the international world (McGee, 2016). In short, Australia has a high tax rate (30%) than most of the countries in the international world.

In 2014, the corporate tax rate of Australia was above those of Asian and European countries. However, the G7 countries including France, Italy, Japan, and the United States among others reported a higher tax rate (Richardson, 2015). Although the 30% tax rate is high to other countries who would wish to invest in Australia, it is favorable for the shareholders doing business in Australian companies. That is, the dividend imputation tax system favors the stakeholders since most of the tax is paid by the company. On the other hand, lowering the country's tax rate will result in other foreign countries paying less tax which may deteriorate the country's economy. Therefore, the high tax rate is meant to benefit local shareholders in big companies and also despise foreign investors since the taxation does not apply to them.

Arguments for Reducing Tax Pay Rate for Australian Company

Due to the high tax pay rate in an Australian company, many debates have been raised in the Federal Parliament to discuss the issue. As a result, hot arguments have always emerged yet no solutions about the high tax rate have been reached. The arguments are based on whether company tax rate should be reduced, or it remains at 30%. Some scholars argue that company tax is paid by the public indirectly and so levying many taxes to the companies is as equal as forcing the public to pay extra taxes. They prefer that the tax rate is reduced to 25%.

Since the recommendation that was made by the Rudd government in 2010 to lower the tax, no change has been witnessed. Countries such as the USA, UK, and Japan on which Australia depends have had some tax cuts, resulting in the fall of Australian business to lack investors from such countries (Wild, 2018). As such, the country should consider reducing the tax rate to encourage investors to come and grow business in Australia. Still, as explained earlier, local stakeholders in big companies argue that the company taxes should remain at 30% since it saves them from paying taxes on their own. The difference in opinions on the issues of reducing taxes has even reached a level of being taken to the Federal Government for debating and voting without success. Consequently, the high taxes remain stagnant as the economy keeps changing with time and investors cannot come to the country to invest there.

Conclusion

According to information retrieved from various sources, the tax rate of Australian Company seems to be higher in that foreign stakeholders cannot afford to come to the country to invest. Nevertheless, the high tax rate is a benefit to local stakeholders since they do not pay taxes anymore after the company has paid. Therefore, the state of the tax rate is in one way beneficial and in another way harmful, especially to the common resident of Australia who cannot afford to live a luxury life. It has also affected how the country relates with other countries in the international trade even when Australia has valuable goods to export such as iron ore. As such, the country should try to balance the income tax so that it benefits not only local stakeholders but also external stakeholders and the Australian population at large. In doing so, there will be a consistent growth of in trade and an increase in demand and supply of Australian goods.

References

Chardon, T., Freudenberg, B. and Brimble, M., 2016. Tax literacy in Australia: not knowing your deduction from your offset. Austl. Tax F., 31, p.321.

Herault, N. and Azpitarte, F., 2015. Recent Trends in Income Redistribution in Australia: Can Changes in the TaxBenefit System Account for the Decline in Redistribution?. Economic Record, 91(292), pp.38-53.

Kawano, L., & Slemrod, J. (2016). How do corporate tax bases change when corporate tax rates change? With implications for the tax rate elasticity of corporate tax revenues. International Tax and Public Finance, 23(3), 401-433.

McGee, R., Devos, K. and Benk, S., 2016. Attitudes towards tax evasion in Turkey and Australia: A comparative study. Social Sciences, 5(1), p.10.

Richardson, G., Taylor, G. and Lanis, R., 2015. The impact of financial distress on corporate tax avoidance spanning the global financial crisis: Evidence from Australia. Economic Modelling, 44, pp.44-53.

Wild, D., 2018. Time for a tax revolution. Institute of Public Affairs Review: A Quarterly Review of Politics and Public Affairs, The, 70(1), p.28.

Cite this page

Economics and International Trade in Australia Paper Example. (2022, Aug 08). Retrieved from https://proessays.net/essays/economics-and-international-trade-in-australia-paper-example

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Essay on Employment Law in the Twenty-First Century

- Essay Example on Samsung's Cultural Competency: Achieving Global Success

- Essay on Employer Liable for Employee Actions: Respondeat Superior

- Essay on Exploring Global Commodity Chains & Globalization: Impacts on Products & Consumers

- Essay on Youth Violence: Unemployment a Core Source of Violation

- Conflicting Opinions on Globalization: Pros & Cons - Essay Sample

- Paper Sample on Digitalization: A Global Phenomenon Shaping Our Lives