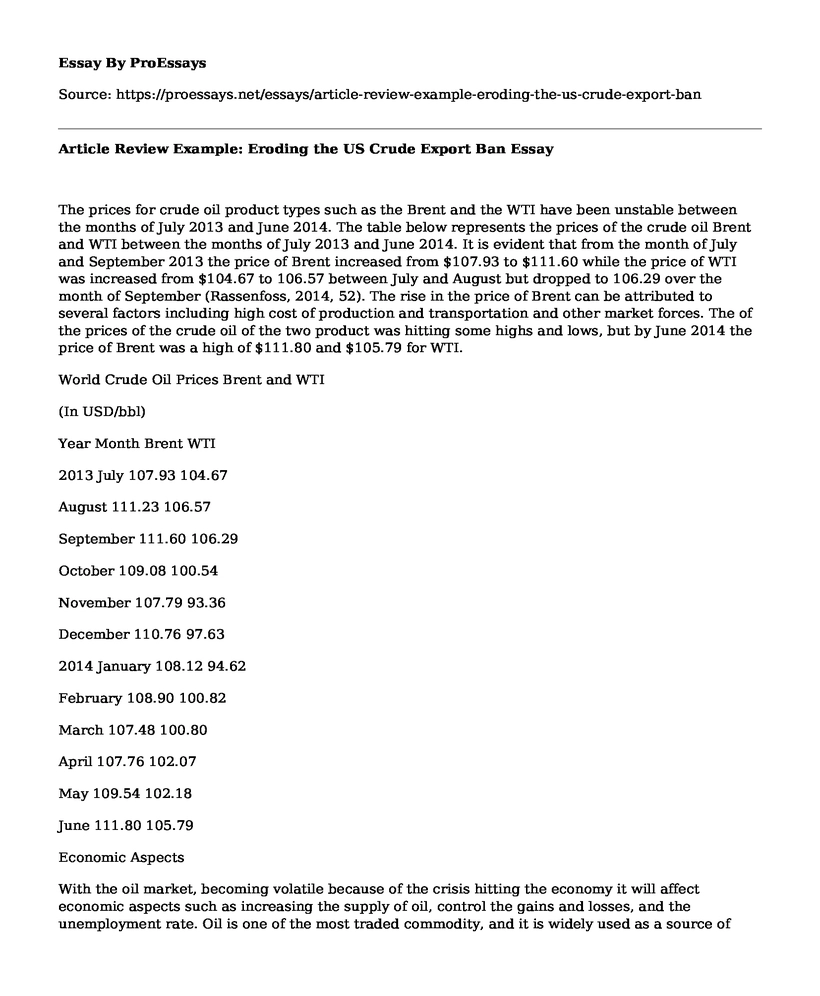

The prices for crude oil product types such as the Brent and the WTI have been unstable between the months of July 2013 and June 2014. The table below represents the prices of the crude oil Brent and WTI between the months of July 2013 and June 2014. It is evident that from the month of July and September 2013 the price of Brent increased from $107.93 to $111.60 while the price of WTI was increased from $104.67 to 106.57 between July and August but dropped to 106.29 over the month of September (Rassenfoss, 2014, 52). The rise in the price of Brent can be attributed to several factors including high cost of production and transportation and other market forces. The of the prices of the crude oil of the two product was hitting some highs and lows, but by June 2014 the price of Brent was a high of $111.80 and $105.79 for WTI.

World Crude Oil Prices Brent and WTI

(In USD/bbl)

Year Month Brent WTI

2013 July 107.93 104.67

August 111.23 106.57

September 111.60 106.29

October 109.08 100.54

November 107.79 93.36

December 110.76 97.63

2014 January 108.12 94.62

February 108.90 100.82

March 107.48 100.80

April 107.76 102.07

May 109.54 102.18

June 111.80 105.79

Economic Aspects

With the oil market, becoming volatile because of the crisis hitting the economy it will affect economic aspects such as increasing the supply of oil, control the gains and losses, and the unemployment rate. Oil is one of the most traded commodity, and it is widely used as a source of energy. The increase in oil production in U.S has begun to affect the international oil market despite the United States ban on oil exports. Moreover, a good example of this change is the departure of an oil tanker from Texas to Asia with around 400,000 barrels of crude oil. The move has open doors for exports as the region can make more income resulting to the economic growth of the regions. Moreover, the article also talks about inflation that will be brought the flow of revenue. Without proper regulation, the inflation rate will likely to increase as there will be more money in circulation than the economy needs (Rassenfoss, 2014, 53). This might result in devaluation of the dollar against other foreign currencies. Further, the rate of unemployment in the region is likely to drop this is because the new technology will need people to drive it and the unemployed will get jobs improving the quality of life for the individuals in the area. This includes driving the automated ocean-bottom nodes for the exploration of oil and gas deposit.

Economic evaluation is a process of systematic, valuation, measurement, and identification of outcomes and inputs of two different activities. Primarily, the purpose of the process is to identify a better course of action looking at the evidence available. The article is mainly concerned with the eroding the use crude export ban. It is understandable that the United States is one of the largest importers of crude oil. The country has some deposits of crude oil, but they are not adequate to feed the nation's demand. Conduction an evaluation no whether the state should continue with the ban on crude oil export or should start shipping the product will enable the government determines the best way forward (Rassenfoss, 2014, 53). Moreover, the nation has a boom in the crude oil production, and it would be economic wise to cash in on the excess product. This brings about more income to the nation from the large deposits of hydrocarbons. Moreover, a study shows that United States oil producers earn a higher price for their oil resulting in a greater domestic oil production. It is projected that the projected that by the year 2022 the production level would reach 11.2 BOPD from a low of 8.2 million BOPD in 2016. This indicates that U.S exports will only slightly be lower that the global market oil demand. Moreover, the crude oil for the U.S will find a ready market in Africa, Asia, and Europe.

The article gives a good example of market supply by stating that by 2022 the nation's crude oil will get direct markets in Africa, Asia, and Europe. With the oil production booming in U.S it is evident that the nation will have to sell it excess oil to some of this nation. The article also states that the oil production will enable producers to make more money in that period to allow economic growth in the region.

The report says that with the self-sufficient program the nation can export its oil to some areas that might be in demand of the commodity. The United States have a strong trade relationship with some countries that import this product. It can use its influence to encourage some of these nations to purchase its oil. Further, with the oil deposits in Africa and Russia depleting the boom in the U.S present a chance to capture these markets (Rassenfoss, 2014, 53). These nations will leave some markets unsupplied with the precious commodity, and it would be a perfect opportunity for the oil producers in the U.S to capture these markets before they move to other nations. These are good examples of market demand that the United States can take advantage of.

Time values of money is an economic concept that argues that money held or received today has a significant or different value with money to be received shortly. There are several aspects in the article that will ab affected by time values of money. Firstly, the values of crude oil. The future of the oil prices is uncertain as they prices have been reducing over the last few years. It is crucial that the country takes advantage of the high oil prices and sell its products to the world will the prices and use that money to make investments in values areas to improve the economy (Rassenfoss, 2014, 52). Time value of money argues that money received today is more valuable that money promised to be received shortly. This put into account that inflation is always rising and that the individual or the state can use that money to make other investment, which is important.

In conclusion, the prices for crude oil product types such as the Brent and the WTI have been unstable between the months of July 2013 and June 2014. The article reviews several economic aspects which include increasing the supply of oil, control the gains and losses, and the unemployment rate. The article is mainly concerned with the eroding the use crude export ban. It is understandable that the United States is one of the largest importers of crude oil. The country has some deposits of crude oil, but they are not adequate to feed the nation's demand.

References

Rassenfoss, S. 2014. Eroding the US Crude Export Ban. SPE 52-53

Cite this page

Article Review Example: Eroding the US Crude Export Ban. (2021, Apr 07). Retrieved from https://proessays.net/essays/article-review-example-eroding-the-us-crude-export-ban

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- The Law Regarding Undocumented Employees in the United States

- Essay on Current Economic Events and How It Relates to the Principle of Macroeconomic

- Singapore Economic Growth for the Period 2004 - 2015 Paper Example

- Equal Employment Opportunity Act 1972 Paper Example

- Salary Negotiation With a Potential Employer Essay Example

- Essay Sample on Employee Privacy Rights: Balancing Employer Access and Protection

- Employee Turnover: Causes, Challenges & Solutions - Essay Sample