The common analysis of both the income statement and the balance sheet indicates a relatively good performance. The capital structure of the organization is reasonably good as per the industry.

Fund statement analysis

The use of the funds borrowing proposed will eliminate the notes payable making the current ratios better and more reliable. It is because the organization aims at clearing the notes payable and increases the long-term debt. The fixed assets ratios are stable and hence the new borrowing will not have an adverse impact on the organization operations (Frost, 2004). The use of the remaining amount of the loan in funding working capital would make the functioning of the organization better and hence making more sales. The interest paid on the notes payable will be used to pay for the new funds interest and because of the wider loan period, it will be lower.

Loan analysis

The company ability's to pay the loan interest when dues after acquiring the new credit will be good as a result of the released interest paid for notes. On top, the company has a relatively good performance and hence its cash flow management is good. The ratio of the enterprise indicates that the longevity of its operation is certain (Frost, 2004). Since the ratios are almost within the industry ratios, the loan period is acceptable and not risky. The loan can also be secured on the floating assets to ensure that the risk is reduced. The organization has a record of borrowing as indicated in the financial statements particularly the balance sheet. The past borrowing history can be an indication that the directors pay debts and their commitment to pay the loan is not questionable. Therefore, the credit can be granted but, there should be terms to protect further borrowing that would endanger the liquidity of the company (Frost, 2004).

References

Frost, S. (2004). A Bank Analyst's Handbook. Hoboken, NJ: J. Wiley & Sons.

Appendix

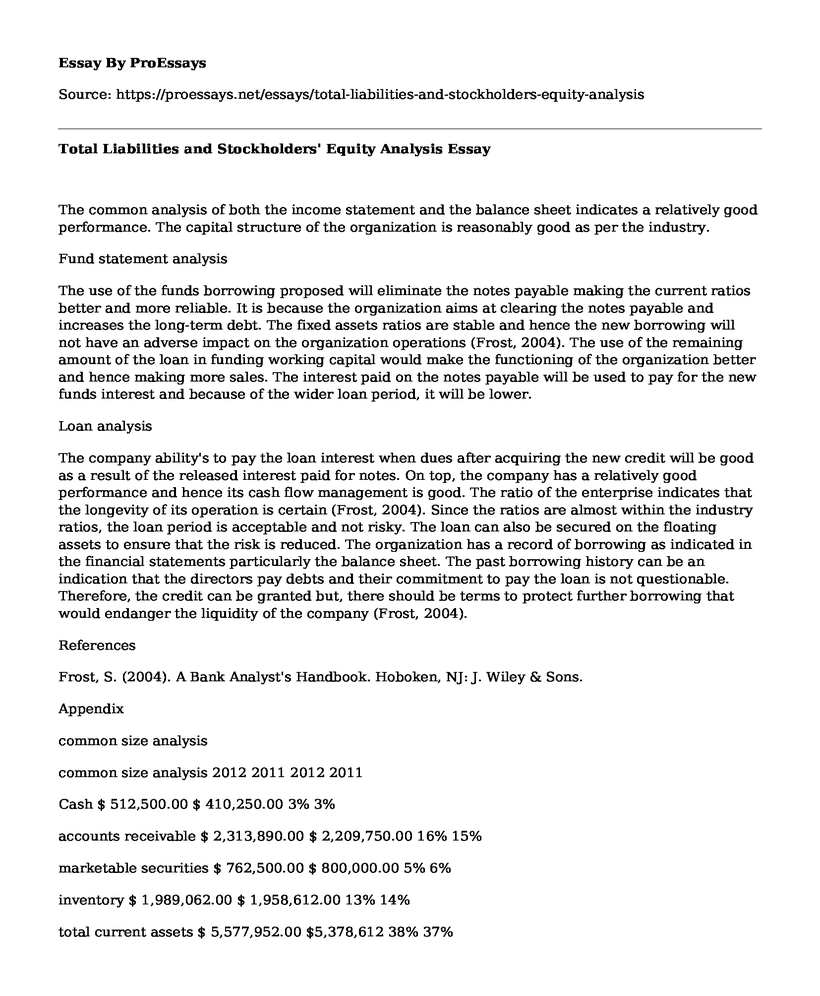

common size analysis

common size analysis 2012 2011 2012 2011

Cash $ 512,500.00 $ 410,250.00 3% 3%

accounts receivable $ 2,313,890.00 $ 2,209,750.00 16% 15%

marketable securities $ 762,500.00 $ 800,000.00 5% 6%

inventory $ 1,989,062.00 $ 1,958,612.00 13% 14%

total current assets $ 5,577,952.00 $5,378,612 38% 37%

total fixed assets $ 9,184,547.00 $9,079,267 62% 63%

total assets $ 14,762,499.00 $ 14,457,879.00 100% 100%

LIABILITIES

ACCOUNTS PAYABLE $ 2,875,000.00 $ 2,621,250.00 19% 18%

NOTES PAYABLE $ 1,427,500.00 $ 1,275,000.00 10% 9%

MORTGAGE - CURRENT PORTION $ 187,500.00 $ 252,255.00 1% 2%

TOTAL CURRENT LIABILITIES $ 4,490,000.00 $ 4,148,505.00 30% 29%

MORTGAGE DEBT- LONG TERM $ 3,913,125.00 $ 4,793,000.00 27% 33%

TOTAL LIABILITIES $ 8,403,125.00 $ 8,941,505.00 57% 62%

STOCKHOLDERS EQUITY

COMMON STOCKS $ 2,100,000.00 $ 2,100,000.00 14% 15%

PAID IN CAPITAL $ 966,374.00 $ 966,374.00 7% 7%

RETAINED EARNINGS $ 3,293,000.00 $ 2,450,000.00 22% 17%

TOTAL STOCKHOLDERS EQUITY $ 6,359,374.00 $ 5,516,374.00 43% 38%

TOTAL LIAB. & STOCKHOLDERS EQUITY $14,762,499 $14,457,879 100% 100%

INCOME STATEMENTS: 2012 2011 2012 2011

SALES $ 16,665,000.00 $ 15,053,750.00 100% 100%

COST OF GOODS SOLD $ 9,270,000.00 $ 7,987,000.00 56% 53%

GROSS PROFIT $ 7,395,000.00 $ 7,066,750.00 44% 47%

OPERATING EXPENSES:

FIXED CASH OPERATING EXPENSES $ 1,925,000.00 $ 1,725,000.00 12% 11%

VARIABLE OPERATING EXPENSES $ 1,840,000.00 $ 1,788,000.00 11% 12%

DEPRECIATION $ 480,000.00 $ 380,000.00 3% 3%

TOTAL OPERATING EXPENSES $ 4,245,000.00 $ 3,893,000.00 25% 26%

EARNINGS BEFORE INTEREST & TAXES $ 3,150,000.00 $ 3,173,750.00 19% 21%

INTEREST $ 1,332,500.00 $ 1,315,000.00 8% 9%

EARNINGS BEFORE TAXES $ 1,817,500.00 $ 1,858,750.00 11% 12%

TAXES $ 727,000.00 $ 743,500.00 4% 5%

NET INCOME $ 1,090,500.00 $ 1,115,250.00 7% 7%

LESS PREFERRED STOCKS DIVIDENDS $ 247,500.00 $ 278,125.00 1% 2%

EARNINGS AVAILABLE FOR COMMON STOCKHOLDER $ 843,000.00 $ 837,125.00 5% 6%

Cite this page

Total Liabilities and Stockholders' Equity Analysis. (2021, Mar 08). Retrieved from https://proessays.net/essays/total-liabilities-and-stockholders-equity-analysis

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Change of Budget: Combat Gears Inc

- General and Life Classes of Insurance - Paper Example

- Accounting Fraud at WolrdCom Case Study Paper Example

- Maximizing Returns With Portfolio Diversification: Sharpe, Markowitz and MPT - Essay Sample

- Research Paper on The Banking Industry's Revolutionary History in the U.S.

- Essay Example on Cultural Impact on Financial Education at Chase Bank

- Essay Example on Global Customers' Bank Accounts Compromised by Phishing Emails