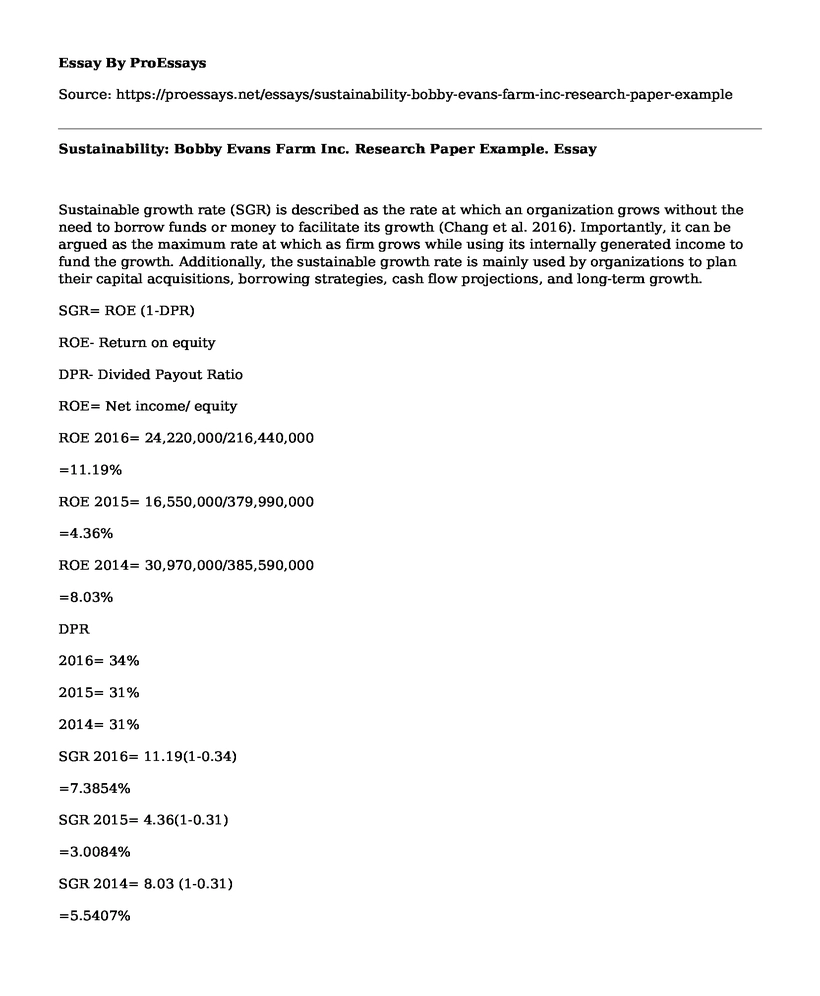

Sustainable growth rate (SGR) is described as the rate at which an organization grows without the need to borrow funds or money to facilitate its growth (Chang et al. 2016). Importantly, it can be argued as the maximum rate at which as firm grows while using its internally generated income to fund the growth. Additionally, the sustainable growth rate is mainly used by organizations to plan their capital acquisitions, borrowing strategies, cash flow projections, and long-term growth.

SGR= ROE (1-DPR)

ROE- Return on equity

DPR- Divided Payout Ratio

ROE= Net income/ equity

ROE 2016= 24,220,000/216,440,000

=11.19%

ROE 2015= 16,550,000/379,990,000

=4.36%

ROE 2014= 30,970,000/385,590,000

=8.03%

DPR

2016= 34%

2015= 31%

2014= 31%

SGR 2016= 11.19(1-0.34)

=7.3854%

SGR 2015= 4.36(1-0.31)

=3.0084%

SGR 2014= 8.03 (1-0.31)

=5.5407%

Because of fluctuations in the markets and internal cash flow, internal funding for growth may be frustrating and challenging for the organization to be a going concern. Importantly, the desirable SGR is a growth rate of 15% and 20%. As per the above calculation, the SGRs of Bobby Evans Farm Inc. for the years 2014, 2015, and 2015 are 5.5407%, 3.0084, and 7.3854% respectively ("Bob Evans Farms Inc.", 2017). This means that as of 2016 the organization had the capacity and ability to growth using the internally raised revenues at a rate of 7.3854%. This is a good growth compared to the previous year where the growth rate had hit a low of 3.0084% off the three years. Primarily, the desirable SGR for any organization is between 15% and 20% ("Bob Evans Farms Inc.", 2017). If the firm needs to meet that desirable rate it means it has to borrow from outside companies as banking institutions and the government.

Meeting the SGR it the dream of any organization but there as some instance that can lead to failure to reach those objectives. The factors that seem to be hindering bobby evens farm Inc. include firstly; the modern day consumer appears to have less disposable income. Consequently, the consumers become conservative when spending is discriminating buyers (Chang et al. 2016). Moreover, the company competes with for the same customers who have less disposable income with other firms leading to decreasing growth and slashing prices to attract consumers. Additionally, the organization is investing the little income it generates in new products to keep the existing customers and keep the happy. Similarly, the investment cuts the companys ability to achieve its SGR and grow.

Additionally, the planning ability affects Bobby Evan Farm Inc. capacity to achieve and maintain sustainable growth. The organization management gets confused between growth capability and the misleading optimal about SGR. This is the main reason why the firm that the company is experiencing a slow growth over the past few years. Notably, between the two years, it is evident that the growth is slow with the SGR hitting a low of 3.0084% in 2015 ("Bob Evans Farms Inc.", 2017). This indicates that the management of the firm needs to go back to the drawing board and identify the reasons why the firm has a low growth rate. However, with the slow growth, the company will only be visible in both the short-term and long-term. Moreover, when the growth exceeds the SGR, the company must come up with ways to sell some equity, reduce dividend payout, decrease asset to sales ratio, and increase the profit margins (Chang, Ting, Woon, Chiu, & Hong, 2016). This is the only way that the firm will launch to cope with the growing rate. Additionally, other factors will result to raise SGR to higher levels.

The company seems to be doing fine as it does not have any external funding of the same periods. This is good for the enterprise, but it is not good for the long-term strategy as the firm has a very low growth rate, which is below the desired level (Chang et al. 2016). Moreover, when the company grows at a rate that is above the SGR in needs to devise a mechanism to sell some equity, reduce dividend payout, decrease asset to sales ratio, and increase the profit margins. This strategy will help the company cope with growth and have extra income to invest.

In conclusion, SGR is described as the rate at which an organization grows without the need to borrow funds or money to facilitate its growth. The sustainable growth rate is mainly used by organizations to plan their capital acquisitions, borrowing strategies, cash flow projections, and long-term growth. Importantly, factors are crucial when the company growth rate is above SGR. The factors include, sell some equity, reduce dividend payout, decrease asset to sales ratio, and increase the profit margins. Factors that seem to be hindering bobby evens farm Inc. include firstly; the modern day consumer seems to have less disposable income. Additionally, the organization is investing the little income it generates in new products to keep the existing customers and keep the happy. Similarly, the investment cuts the company's ability to achieve its SGR and grow.

References

Bob Evans Farms Inc.. (2017). Marketwatch.com. Retrieved 31 January 2017, from http://www.marketwatch.com/investing/stock/bobe/financials/income-statement

Bob Evans Farms Inc.. (2017). Marketwatch.com. Retrieved 31 January 2017, from http://www.marketwatch.com/investing/stock/bobe/financials/balance-sheet

Chang, Y. C., Ting, S. C., Woon, H. K., Chiu, C. W., & Hong, S. T. (2016, May). Strategic Analysis of Taiwan Liner Shipping Companies by Using the Sustainable Growth Model. In International Forum on Shipping, Ports and Airports (IFSPA) 2015: Empowering Excellence in Maritime and Air Logistics: Innovation Management and Technology.

Cite this page

Sustainability: Bobby Evans Farm Inc. Research Paper Example.. (2021, Jun 01). Retrieved from https://proessays.net/essays/sustainability-bobby-evans-farm-inc-research-paper-example

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Ford Motor Company: Financial Statement Analysis

- Finance Essay Sample: Audit of Cash and Financial Instruments

- Analysis of Ethics and the Fundamental Ethical Principles Applicable in Auditing

- Numbers: An Essential Part of Our Real-World Experience - Essay Sample

- Essay Example on Nike: Ethical Practices Amidst Accusations of Forced Labor and Carbon Emissions

- Paper Sample on Fair Value Adjustments to Debt: Impact on Financial Statements

- Healthcare for Undocumented Immigrants- Report Sample