According to Summers (2016), the theory of secular stagnation remains a reality in the currently developed economies. The theory postulates that the developed economies may continue to experience between negligible and non-existent growth in a market-based economy in the foreseeable future. Principal proponents of the secular stagnation theory in the modern age point to the surprisingly low recovery rate of the developed economies from the economic crisis of 2007-2008 (The Economist 2014). This theory, however, is not new to global economies. It was first proposed and popularized by Alvin Hansen to explain the post-crisis stagnation of the global economies in the 1930s (Raposo 2019). Hansen projected a pile-up in savings and a corresponding reduction in investments, thus lowering the neutral real interest rate.

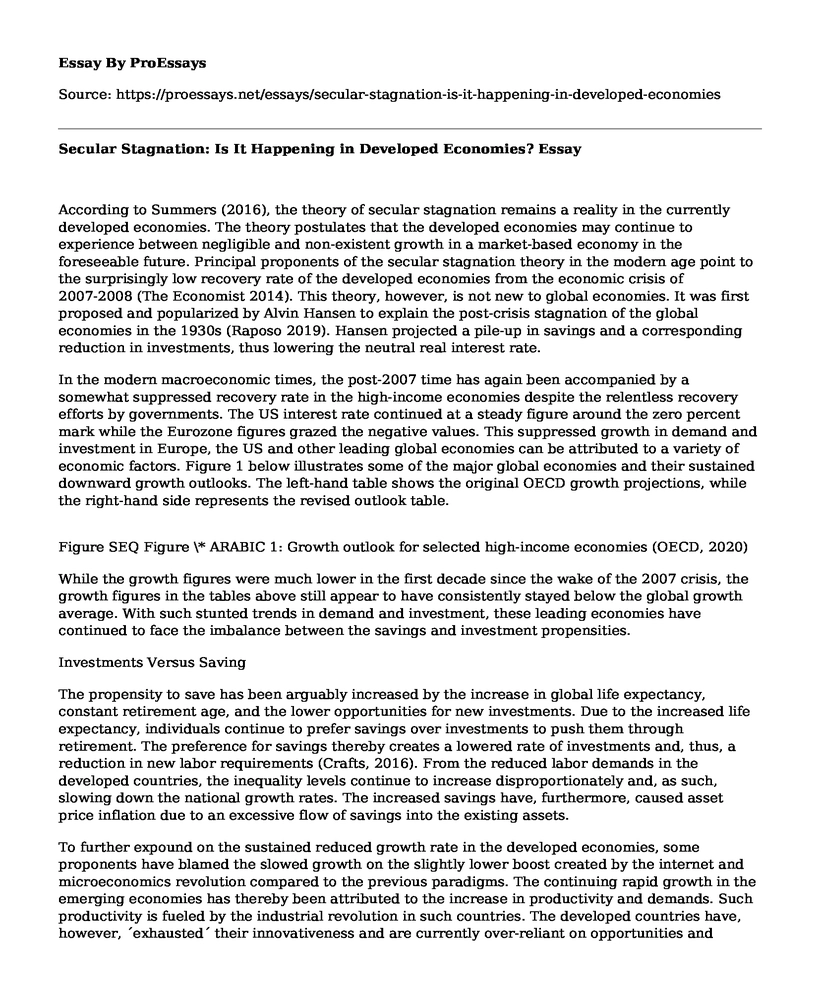

In the modern macroeconomic times, the post-2007 time has again been accompanied by a somewhat suppressed recovery rate in the high-income economies despite the relentless recovery efforts by governments. The US interest rate continued at a steady figure around the zero percent mark while the Eurozone figures grazed the negative values. This suppressed growth in demand and investment in Europe, the US and other leading global economies can be attributed to a variety of economic factors. Figure 1 below illustrates some of the major global economies and their sustained downward growth outlooks. The left-hand table shows the original OECD growth projections, while the right-hand side represents the revised outlook table.

Figure SEQ Figure \* ARABIC 1: Growth outlook for selected high-income economies (OECD, 2020)

While the growth figures were much lower in the first decade since the wake of the 2007 crisis, the growth figures in the tables above still appear to have consistently stayed below the global growth average. With such stunted trends in demand and investment, these leading economies have continued to face the imbalance between the savings and investment propensities.

Investments Versus Saving

The propensity to save has been arguably increased by the increase in global life expectancy, constant retirement age, and the lower opportunities for new investments. Due to the increased life expectancy, individuals continue to prefer savings over investments to push them through retirement. The preference for savings thereby creates a lowered rate of investments and, thus, a reduction in new labor requirements (Crafts, 2016). From the reduced labor demands in the developed countries, the inequality levels continue to increase disproportionately and, as such, slowing down the national growth rates. The increased savings have, furthermore, caused asset price inflation due to an excessive flow of savings into the existing assets.

To further expound on the sustained reduced growth rate in the developed economies, some proponents have blamed the slowed growth on the slightly lower boost created by the internet and microeconomics revolution compared to the previous paradigms. The continuing rapid growth in the emerging economies has thereby been attributed to the increase in productivity and demands. Such productivity is fueled by the industrial revolution in such countries. The developed countries have, however, exhausted their innovativeness and are currently over-reliant on opportunities and demands provided by the internet revolution. The digital economies are, therefore, much less capital-absorbing and labor-intensive compared to the previous epochs. Trying, for instance, to liken the jobs and investment boom in the wake of Fordism to the investment demands from the microelectronics revolution seems like an unfair comparison (Summers, 2016).

The proponents to the limit to growth school of thought seem to attribute the potential secular stagnation to the exhaustion of environmental production resources. This perspective argues the concept of energy returned on energy invested (EROEI). EROEI use may sometimes act to slow down the rate of long-term investment plans if the plans significantly reduce the EROEI.

Outputs Focus

In the efforts to help explain the slow growth rate in the US, Gordon (2014) adopted the "slow long-term growth" approach. In his plan, he differed slightly with Summers on the focal point of their economic analyses. While Summers (2016) had focused on the demand and corresponding nominal interest, Gordon (2014) instead focused on the output factors. Gordon (2014) postulated that the GDP of the US would grow at a slow pace of just 1.4% to 1.6%. In his projections, such growth trends would be sustained for a period of nearly 40 years, thus defining the growth as "slow long-term growth" rather than secular stagnation. Gordon, however, still portrays a grime mood on the growth of the western economy as the modern economy does not seem to provide opportunities that were observed in the post-war era of the 1940s.

From the postulations by both Summers and Gordon, the demand and output variables can change rapidly and raise the economic performance of the west if a disruptive trend in the modern technological revolution intervenes. The current advancements in technology are, however, seen as more capital-retaining than capital-distributing (Summers, 2016). Amazon, for instance, has impacted the physical presence of stores and malls. Netflix and other streaming sites are changing cinema expansions significantly. Uber, Airbnb, Google, among others, are furthermore intent at retaining capital and reducing asset expansions. Such trends in capital conservation are thereby highly impactful to the circulation of investments and the overall macroeconomic directions. For the economic growth in such service-centered economies to resume at a similar rate as the industrial age, the services must increase financial circulation among the shareholders and investment demands for various nations.

Recovery Efforts

While attempting to assist in economic recovery plans, governments like the US government continue to hike interest rates (Cox, 2018). Such increased rates will assist in managing inflation rates and, as such moderating economic growth (Pettinger, 2019). The US government has, for instance, continued to hike interest rates continue to assist in managing the effects of heightened inflation. While this endogenous move may appear to assist in manage the inflation rates, it also increases the likelihood of savings and reduces investments. Such an approach to macro-economic management will thereby only stabilize the economy in the short-term but will likely lead to a slow long-term rate of growth.

In the UK and Europe, the primary cause of slow growth trends is the demographic headwind. The retiring baby boom generation in the European countries continues to impact the per capita GDP growth. Education and systemic inequalities are the other headwinds that are projected to impact the growth trends immensely. The low job uptake for the graduating youths is worsened by the increasing disparities in payments among the workforce (Crafts, 2016). Such income inequalities further create a mismatch between expertise and employment worth hence slowing down productivity. Austerity policies set by most of the southern European countries to salvage the economic condition did not assist much in restoring the growth trajectory after the 2007 crisis (Probst, 2020).

Conclusion

Despite the current low rate of growth and demand in the technological revolution, it is still projected that technological growth will continue to increase. Such an increase will thereby increase investment demands and employment of the current crop of graduates. Sustained internal investment demands and calls for Liquidity must, as such, be encouraged by the national agencies if the developed economies are to experience increased economic growth (Crafts, 2016).

Bibliography

Cox, J., 2018. Fed hikes rate, lowers 2019 projection to 2 increases. CNBC. Available at: https://www.cnbc.com/2018/12/19/fed-hikes-rates-by-a-quarter-point-.html [Accessed May 28, 2020].

Crafts, N., 2016. Is Secular Stagnation the Future for Europe? Productivity Puzzles Across Europe, pp.49-67.

The Economist, 2014. Fad or fact? The Economist. Available at: https://www.economist.com/free-exchange/2014/08/16/fad-or-fact [Accessed May 28, 2020].

Gordon, R.J., 2014. The turtle's progress: Secular stagnation meets the headwinds. voxeu.org. Available at: https://voxeu.org/article/turtle-s-progress-secular-stagnation-meets-headwinds [Accessed May 28, 2020].

OECD, 2020. The global economy risks falling ill, OECD Economic Outlook, Interim Report March 2020. OECD Economic Outlook. Available at: http://www.oecd.org/economic-outlook/ [Accessed May 28, 2020].

Pettinger, T., 2019. Effect of raising interest rates. Economics Help. Available at: https://www.economicshelp.org/macroeconomics/monetary-policy/effect-raising-interest-rates/ [Accessed May 28, 2020].

Probst, J., 2020. Secular stagnation: it's time to admit that Larry Summers was right about this global economic growth trap. The Conversation. Available at: https://theconversation.com/secular-stagnation-its-time-to-admit-that-larry-summers-was-right-about-this-global-economic-growth-trap-112977 [Accessed May 28, 2020].

Raposo, I.G., 2019. Secular stagnation and the future of economic stabilisation. Available at: https://www.bruegel.org/2019/04/secular-stagnation-and-the-future-of-economic-stabilisation/ [Accessed May 28, 2020].

Summers, L., 2016. The Age of Secular Stagnation. Larry Summers. Available at: http://larrysummers.com/2016/02/17/the-age-of-secular-stagnation/ [Accessed May 28, 2020].

Cite this page

Secular Stagnation: Is It Happening in Developed Economies?. (2023, Aug 16). Retrieved from https://proessays.net/essays/secular-stagnation-is-it-happening-in-developed-economies

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- The Ethical, Environmental and Economic Situation in An Enemy of the People

- Haber Process Essay Example

- Essay Sample on Gender Issues in the Society

- Movie Analysis Essay on Ninotchka Film and From Russia With Love

- Essay Example on Workplace Violence: Understanding & Mitigating Factors

- Movie Analysis Essay on "Cruel Story of Youth"

- Essay Example on Elder Abuse in Nightingale Square: A Prevalent Challenge