Introduction

The rate of inflation is at 2% and this signify that the rate of unemployment with have to increase up to 6%, where a rapid change in price of goods and services results. Then at point B, the increase in rate of inflation is at 5% leads to more purchase of goods and service thus encouraging high demand of workers in production, this lowers the rate of unemployment to 3%. The economic growth is too high due to improved economic development in the U.S economy.

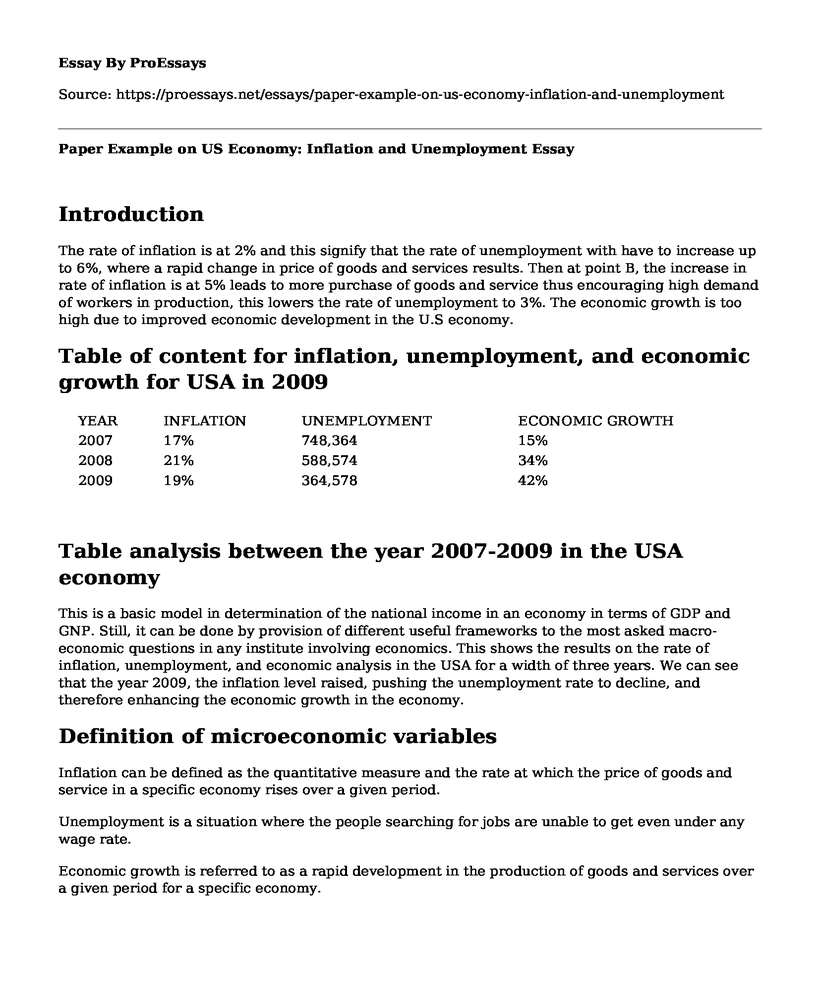

Table of content for inflation, unemployment, and economic growth for USA in 2009

| YEAR | INFLATION | UNEMPLOYMENT | ECONOMIC GROWTH |

| 2007 | 17% | 748,364 | 15% |

| 2008 | 21% | 588,574 | 34% |

| 2009 | 19% | 364,578 | 42% |

Table analysis between the year 2007-2009 in the USA economy

This is a basic model in determination of the national income in an economy in terms of GDP and GNP. Still, it can be done by provision of different useful frameworks to the most asked macro-economic questions in any institute involving economics. This shows the results on the rate of inflation, unemployment, and economic analysis in the USA for a width of three years. We can see that the year 2009, the inflation level raised, pushing the unemployment rate to decline, and therefore enhancing the economic growth in the economy.

Definition of microeconomic variables

Inflation can be defined as the quantitative measure and the rate at which the price of goods and service in a specific economy rises over a given period.

Unemployment is a situation where the people searching for jobs are unable to get even under any wage rate.

Economic growth is referred to as a rapid development in the production of goods and services over a given period for a specific economy.

Monetary policy

In a situation where the exchange rate weakens of a country, in our case U.S, the currency is deemed to be worthless as compared to the other currencies worldwide. There are numerous ways of controlling inflation. For example, controlling the inflation rate may be accompanied by price control measures which in return cause job losses and recession. One significant ways of controlling inflation are by setting up a contractionary monetary strategy. The function of the policy is to target in reducing money supply in the economy thus decreasing bond prices and at the same time increasing the interest rate. This aid in cutting government spending since there is less money circulating in the marketplace, thereby aiming at saving it rather than spending it. Again during times of inflation, cutting spending is highly essential in regulating the level of inflation, since this declines the economic growth.

First, to convey out contractionary policy there is a need to increase the interest rate and is done by the central bank. Leading money to the banks is increased by the government, therefore increasing the interest rate banks are offering the loans. This, in turn, makes fewer people borrow the loans because of its costs, reducing spending and inflation slows. Similarly reducing money supply in the economy can also mitigate the rise, since the government is the one supposed to hold all income run by the government by increasing imports and decreasing exports rates. Reducing the interest rate lowers the rate of borrowing and encourages individuals to invest while spending more. In results this increase the aggregate demand which helps in increasing the total GDP and decline demand deficient unemployment.

Short run and the long term of nominal and real variables

The objectivity of money is stated as the economic theory. This theory tries to explain the changes in money supply which has only effect on nominal variables and not to real variables. In other terms, a decrease of increase in the money supply causing changes in the level of price of the output of the economy in the U.S. In the new versions of this theory, changes due to money supply may significantly affect the unemployment level, this is for the short run only, but for the long term is assumed to be after the money circulations in the economy.

For the long run money, it is the only that motivates nearly all the macroeconomics theory, and no economists accept the fact of the short run. For instance, a macroeconomist is learning the monetary policy of Federal Reserve (Fed) in the U.S. we know that money supply will change the future capital investments, real wealth, and employment levels in long-run equilibrium.

Fiscal policy

Unemployment is decreased through budgetary policy where it helps in growing the aggregate demand and also the level of economic growth. The administration may require an expansionary fiscal policy which deals with activities like reducing taxes and rising level of government expenditure. Dropping taxes can be raising disposable income and thus upturn consumption level top to higher aggregate demand. This increase in demand increases the real GDP making more produce from the firms which offer a conducive environment for an increase in need of more workers. If there are chances of higher aggregate demand in the economy and steady economic growth, this means that fewer firms will have to go bankrupt, therefore incurring fewer job losses. During times of recession, the economist Keynes advocate of expansionary fiscal policy results in resources like capital and labor to be idle in the economy. It is, therefore, the role of the government to intervene and create extra demand thus reducing unemployment. Impact of higher aggregate demand.

References

Bernanke, B. S., & Mishkin, F. S. (1997). Inflation targeting: a new framework for monetary policy?. Journal of Economic perspectives, 11(2), 97-116.Blanchard, O., & Gali, J. (2010). Labor markets and monetary policy: A New Keynesian model with unemployment. American economic journal: macroeconomics, 2(2), 1-30.

Dohring, B., & Mordonu, A. (2007). What drives inflation perceptions? A dynamic panel data analysis (No. 284). Directorate General Economic and Financial Affairs (DG ECFIN), European Commission.

Kouri, P. J. (1976). The exchange rate and the balance of payments in the short run and in the long run: A monetary approach. The Scandinavian Journal of Economics, 280-304.OECD since the 1960s. What do we know?. The Economic Journal, 115(500), 1-27.

Nickell, S., Nunziata, L., & Ochel, W. (2004). Unemployment in the

Staiger, D., Stock, J. H., & Watson, M. W. (1997). The NAIRU, unemployment and monetary policy. Journal of economic perspectives, 11(1), 33-49.

Svensson, L. E. (1999). Inflation targeting as a monetary policy rule. Journal of monetary economics, 43(3), 607-654.

Taylor, J. B. (2000). Reassessing discretionary fiscal policy. Journal of economic Perspectives, 14(3), 21-36.

Cite this page

Paper Example on US Economy: Inflation and Unemployment. (2023, Jan 02). Retrieved from https://proessays.net/essays/paper-example-on-us-economy-inflation-and-unemployment

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Groceries and Globalization Essay Example

- Essay Sample on Exploring the Balance Between Capitalism & Socialism in The United States

- Australia's Skill Deficiency Crisis: Unanswered Questions - Essay Sample

- Essay Example on U.S Medical Care Organization: A Case Study

- Southampton: 17th Worst UK City for Traffic Congestion - Essay Sample

- Paper Example on THS Strategy: Enhancing Ambulatory Strategies Through Data Integration

- Research Paper Sample on Employee Engagement