Determination of the Project's Weighted Average Cost of Capital

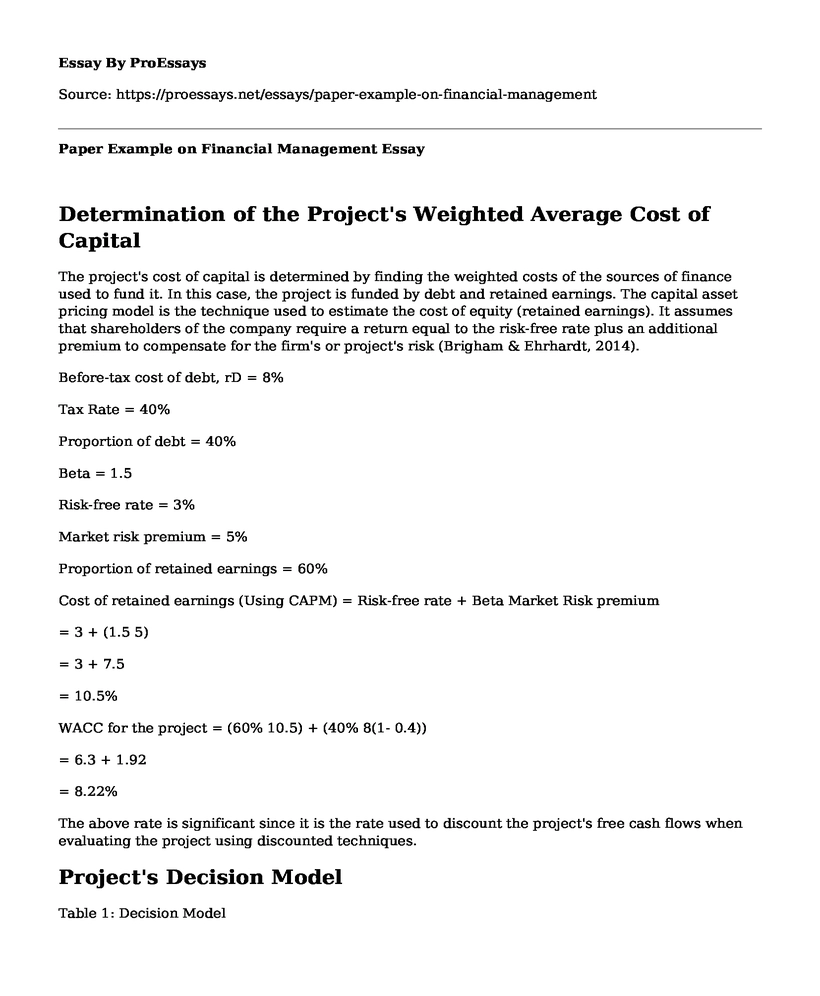

The project's cost of capital is determined by finding the weighted costs of the sources of finance used to fund it. In this case, the project is funded by debt and retained earnings. The capital asset pricing model is the technique used to estimate the cost of equity (retained earnings). It assumes that shareholders of the company require a return equal to the risk-free rate plus an additional premium to compensate for the firm's or project's risk (Brigham & Ehrhardt, 2014).

Before-tax cost of debt, rD = 8%

Tax Rate = 40%

Proportion of debt = 40%

Beta = 1.5

Risk-free rate = 3%

Market risk premium = 5%

Proportion of retained earnings = 60%

Cost of retained earnings (Using CAPM) = Risk-free rate + Beta Market Risk premium

= 3 + (1.5 5)

= 3 + 7.5

= 10.5%

WACC for the project = (60% 10.5) + (40% 8(1- 0.4))

= 6.3 + 1.92

= 8.22%

The above rate is significant since it is the rate used to discount the project's free cash flows when evaluating the project using discounted techniques.

Project's Decision Model

Table 1: Decision Model

Evaluation of the Project

Replacement projects are evaluated based on the incremental effects (Brigham & Ehrhardt, 2014). Thus, we calculate the additional free cash flows as shown in the model above. Incremental cash flows are determined by getting the difference between pre-replacement free cash flows and the expected post-replacement cash flows. The initial cost of the project is reduced by the salvage value of the existing machine. As shown above, the net initial cost of the project is $1,600 while the annual incremental free cash flow is $520. The project is then assessed using techniques such as NPV, IRR, payback, MIRR and discounted payback period.

Net Present Value

This metric shows the difference between the project's initial cost and the present value of all its incremental annual free cash flows (Brigham & Ehrhardt, 2014). It is calculated by discounting the annual incremental free cash flows at the project's cost of capital (8.322%). NPV is the most reliable capital evaluation metric since it considers all cash flows and takes it into account the timing of the project's cash flows (Brigham & Ehrhardt, 2014). The assumed reinvestment rate under this tool is the company's cost of capital. The replacement project is considered worthwhile if its NPV is greater than zero (Brigham & Ehrhardt, 2014). As shown in the above model, the net present value of the replacement project is $113. This is greater than zero implying that the project is viable. If the company replaces the machine, its value will increase by $113 hence it should accept the project and replace the machine.

Internal Rate of Return

This metric indicates that cost of capital at which the firm will be indifferent about the viability of the project (Ross, Westerfield & Jaffe, 2008). This implies that it shows that the rate at which the NPV of the project will be zero. IRR assumes a reinvestment rate equal to the project's internal rate of return (Ross, Westerfield & Jaffe, 2008). The measure is compared with the project's cost of capital to assess the viability of the project. The replacement project is considered viable if its IRR exceeds the cost of capital (8.22%). As shown in the above model, the internal rate of return for the replacement project is 11.39%. This rate is higher than 8.22% (project's WACC) implying that replacing the machine is viable. Thus, the company should acquire the new machine and replace the old one since the expected incremental return is more than the minimum return it requires on its investments.

Modified Internal Rate of Return

MIRR is an advancement of the internal rate of return. It eliminates the weaknesses of IRR since its reinvestment rate assumption is reasonable and consistent with NPV technique. MIRR assumes the project's free cash flows are reinvested at the company's cost of capital (Ross, Westerfield & Jaffe, 2008). It is compared with the cost of capital assess the worthiness of the project. In this case, the replacement project is viewed as viable so long as its MIRR exceeds the cost of capital. The MIRR of the project is 10.10%, as shown in the model above. It indicates that the project is worthwhile since the MIRR exceeds the cost of capital. It implies that if the company replaces the machine, the incremental return will be more than the minimum required rate.

Payback Period

It is the duration the project is expected to generate sufficient incremental free cash flows to cover the net cost of the new machine (Ross, Westerfield & Jaffe, 2008). It is a traditional assessment metric and ignores the timing of cash flows. It also leaves out the incremental free cash flows the machine generates beyond the payback period. It is used for small and less risky projects. As shown above, the replacement machine will take 3.08 years to recover the net cost. The period is shorter than the expected useful life of the new machine. This implies that the firm will recover the net cost of the new machine before the end of its useful life. It suggests that the project is viable and should be undertaken.

Discounted Payback Period

It improves the payback period by incorporating the time value of money (Baker & English, 2011). As shown in the above model, the project's discounted payback period is 3.7 years. This implies that it will take the form three years and eight months to generate sufficient discounted free cash flows to recover the net cost of the new machine. The period is shorter than the project's economic life indicating that replacing the machine is worthwhile. However, the company should compare the discounted payback period with its desired payback period, if any.

Sensitivity Analysis

Sensitivity analysis is vital in project evaluation since not all the variables affecting the viability of the project are certain (Baker & English, 2011). Some variables are uncertain, and changes may adversely affect the project's returns. The analysis shows how changes in one variable affect the NPV and other metrics of the project. In this case, all other variables except the operating cost of the new machine are certain.

As indicated in Table 2 below, a decrease in the annual operating cost from $400 to $300 will lead to an increase in the yearly incremental free cash flows from $520 to $580. Therefore, it will enhance the viability of the project. On the other hand, an increase in operating cost from $400 to $700 will cause a decline in the annual incremental free cash flows from $520 to $340.

Table 2: Sensitivity Analysis

Sensitivity of the Project's NPV

The NPV of the replacement project increases from $113 to $311.66 if the cost of operating the machine falls from $400 to $300. This implies that the viability of the project improves if the company can cut down the annual cost of operating the new machine. However, an increase in the yearly operating cost to $700 will cause a fall in the project's NPV to -$479. This implies that if the cost of operating the new machine increases to $700, it will be no longer worthwhile to replace the machine since it will result in incremental losses.

Figure 1 below shows the movement of the machine's NPV with changes in operating costs. The graph indicates that the NPV of the project will become negative if the annual operating costs increase to more than $460. Thus, it will not be viable anymore to replace the old existing machine. The management of the company must take appropriate measures to prevent the cost from increasing to more than $460.

Figure 1: Sensitivity Analysis - NPV

Sensitivity of the Project's IRR

Figure 2: Sensitivity Analysis - IRR

The IRR of the new machine will increase from 11.39% to 16.72% if the operating costs fall from $400 to $300. However, if the costs rise to $700, the IRR will decline to -6.20% and the project will no longer be worthwhile. As shown in Figure 2 above, the IRR will be equal to the cost of capital (8.22%) as the project's annual operating cost approaches $460.

Sensitivity of the Project's MIRR, Payback Period and Discounted Payback Period

The MIRR of the replacement project will fall to -1% if the operating costs increase to $700. The project's payback period will also increase to 4.7 years if costs rise to $700. The discounted payback period will be more than four years. These measures show that the firm should not replace the machine if the operating cost increases to $700. As indicated by the payback periods, the project will generate sufficient incremental free cash flows to recover the net cost by the end of the new machine's useful life.

References

Baker, H., & English, E. (2011). Capital budgeting valuation. Hoboken, N.J.: J. Wiley & Sons.

Brigham, E., & Ehrhardt, M. (2014). Financial management. Mason (Ohio): South-Western Cengage Learning.

Ross, S., Westerfield, R., & Jaffe, J. (2008). Corporate finance. Boston: McGraw-Hill/Irwin.

Cite this page

Paper Example on Financial Management. (2022, May 22). Retrieved from https://proessays.net/essays/paper-example-on-financial-management

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- UAE Banking Sector Overview

- Importance of Management Accounting in Manufacturing Firms

- New Zealand Banker's Association (NZBA) Paper Example

- Essay Sample on Comprehensive Annual Financial Report

- Essay Example on Construction of HS2 Curzon Street Station to Start April 2020

- Essay Example on Financial Statements: Assets, Liabilities, & Mitigating Errors

- Inheriting $$$: Investing in Government Securities & Real Estate - Essay Sample