Introduction

Ratio analysis is a very important performance measure which is able to show the liquidity, profitability, gearing, and efficiency of a company (Weygandt & Kell,1996). It is simple to use as compared to other performance measures. In order to understand the ability of the business organization to meet its short-term financial obligation, it is essential to compute liquidity ratio such as current and quick ratio (Williams et al, 2008). Efficiency ratios such as account receivable and account payable ratios are essential in showing the number of days a business organization takes to pay its trade creditors and collect debts. They, therefore, show how the company is efficient. This paper, therefore, is focused on evaluating the financial performance of Apple Inc using ratio analysis.

Company Overview

Apple Inc is a technology company that was started in 1977. It has grown significantly to become an international company dealing in production of computers, laptops, computer hardware and software and other devices such as IPad. It has developed its goodwill and therefore most people prefer its products to the products of its competitors. Apple Inc generates a large sales revenue from the sale of computers and other devices and therefore it is assumed to have high financial performance. This condition can be proven by conducting ratio analysis which is potential of showing its financial performance in terms of profitability, liquidity, and gearing.

Liquidity Ratios

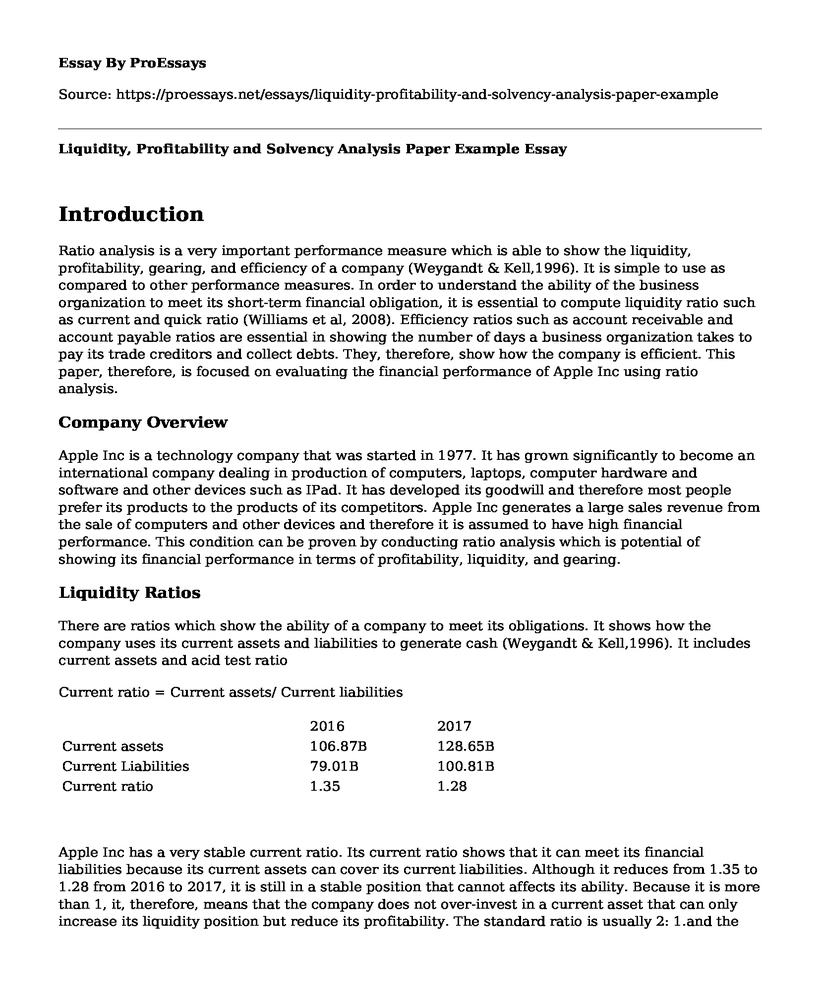

There are ratios which show the ability of a company to meet its obligations. It shows how the company uses its current assets and liabilities to generate cash (Weygandt & Kell,1996). It includes current assets and acid test ratio

Current ratio = Current assets/ Current liabilities

| 2016 | 2017 | |

| Current assets | 106.87B | 128.65B |

| Current Liabilities | 79.01B | 100.81B |

| Current ratio | 1.35 | 1.28 |

Apple Inc has a very stable current ratio. Its current ratio shows that it can meet its financial liabilities because its current assets can cover its current liabilities. Although it reduces from 1.35 to 1.28 from 2016 to 2017, it is still in a stable position that cannot affects its ability. Because it is more than 1, it, therefore, means that the company does not over-invest in a current asset that can only increase its liquidity position but reduce its profitability. The standard ratio is usually 2: 1.and the higher the current ratio, the higher the liquidity position. The current ratio for Apple Inc reduces in 2017 although it is still within the required standards. It is usually said that a ratio of 1:1 is safer and because its current ratio is 1.28, Apple Inc is becoming more capable of turning its current assets into cash very fast. The reduction in current ratio is 2017, means that the current liabilities if Apple Inc has increased significantly and its effect is only felt on the current ratio.

Efficiency Ratios

These are ratios that show the ability of the company to convert its finished goods into sales, its inventories into sales revenues and sales into cash and bank (Houston and Eugene, 2009). It includes accounts receivable collection period, inventory turnover and account payable days. It, therefore, indicates the ability of a business organization to use its resources to generate profits. When there is an increase in efficiency ratio, there is a significant sign that there is proper management of the company assets.

Accounts receivable collection period

Account receivable collection period is the number of days the company takes to collect its debts from debtors. It shows how efficient the company is as compared to others in the same industry.

| 2016 | 2017 | |

| Accounts receivable | 15.81B | 17.93B |

| Sales revenues | 214.23B | 228.57B |

| Ratio | 27days | 29days |

Although there is an increase in the number of days Apple Inc takes to collect its debts from trade creditors, it is still within the manageable levels. Because it is below 30 days' period it cannot run out of cash to meet its financial obligations.

Inventory Turnover

This is the ratio that shows the number of days' inventories takes to be converted into sales revenues (Houston and Eugene, 2009). A higher inventory turnover days, show that the business is efficient and a lower one shows that inventories accumulate in store due to poor sales.

| 2016 | 2017 | |

| Inventories | 2.13B | 4.86B |

| Sales revenues | 214.23B | 228.57B |

| Ratio | 3.6days | 7.8days |

Apple Inc is very efficient. It takes 7.8 days to convert all its stock into sales. Much of its stock does not overstay in the store despite the fact that there is high competition.

Current Cash debt coverage

Current cash debt ratio is not very bad as 19% of cash can cover part of its debt although it reduced significantly. Excess cash may also reduce company profitability and therefore 19% of cash is sufficient to pay for debt without storing excess cash rather than reinvesting in other long-term assets to produce more profits.

| 2016 | 2017 | |

| Cash | 19.38B | 19.15B |

| Debt | 75.43B | 97.21B |

| Ratio | 27% | 19.6% |

Debt to asset ratio

Debt to asset ratio shows the extent to which the company has debt over assets. Apple Inc has 25.9% debt as compared to its assets (Williams et al, 2008). There has been an increase in this ratio from 23.4% to 25.9% and this is insignificant because the company is increasing its borrowings without considering the value of its assets.

| 2016 | 2017 | |

| Debt | 75.43B | 97.21B |

| Assets | 321.69B | 375.32B |

| Ratio | 23.4% | 25.9% |

It is essential when the company has a very small debt margin as compared to assets because too much debt increases the company liability.

Profitability ratios

This is a ratio which shows the ability of a business organization to generate profit for investors. When the profitability value increases, there is an indication that the company performance increases due to increase in the utilization of current assets, capital employed and equity capital. These results in an increase in gross profit margin and net operating profit margin at the end of every financial year (Houston and Eugene, 2009). To interpret the performance of a business organization, it is essential to compare the profitability of two or three consecutive years as this can help in predicting the future performance. Apple Inc invests more on fixed assets by ensuring that it has several retail stores across the globe and this provides an explanation on the decline on return on assets. It is inappropriate for return on the asset to go below 5%, Apple has a higher ROA above 5% showing that it still uses its assets properly to generate high profits.

Asset turnover ratios for Apple Inc also declined significantly by 27% in 2017.It, therefore, shows that it is underutilizing its assets to produce a higher sales revenue. A reduction in return on asset is as a result of over-investment in capital assets which reduces the amount of money the company uses to generate more profits.

Profit margin

Profit margin is a ratio that shows the extent to which sales revenues covers the cost of sales and how gross profits covers the operating cost (Williams et al, 2008). The net profit margin of Apple Inc is very high, the cost of operating activities cannot cover its gross profit and gross profit cannot cover its sales revenues. It, therefore, means that Apple uses its assets effectively to generate profits and high sales revenues.

| 2016 | 2017 | |

| Profit | 82.72B | 86.87B |

| Sales revenues | 214.23B | 228.57B |

| Ratio | 38.61% | 38.00% |

Apple Inc has no change in gross profit margin. It remained at 38.61% although there is a slight decrease in profit margins which could be as a result of the reduction in efficiency level.

Return on common stockholders' equity.

| 2016 | 2017 | |

| Profit | 82.72B | |

| Equity Capital | 128.25B | |

| Ratio | 64.5% |

A higher return on capital employed also shows that the company used its equity capital effectively. The result of the analysis indicates that Apple uses its equity capital well as this makes it generate high returns to shareholders (Williams et al, 2008). Apple uses equity capital effectively and that made it generates high profit for its investors. There is no change in ROE for 2016 and 2017, it remains at a constant rate of 64.5%.

Conclusion and recommendations

2017 was a very successful year for Apple Inc. Apple Inc has worked very hard in ensuring that it maintains its liquidity position and profitability. It invested more in research and development as it could produce other new products to customers. It could also introduce new iPods and other iPhones and this made it increase its focus on the general public. In the process, it builds its goodwill and reputation by focusing more on customer's value. The production of such high-quality products improves its desirability in the minds of investors. In 2017, this company increased its sales revenues by almost 50% although there is high competition from other companies. The only problem is seen when examining its efficiency. There is a reduction in efficiency because the rate at which it converts stock into sales has gown down as compared to the previous years. Liquidity position also changed from 1.35 to 1.28 showing that there is a reduction in current assets with an increase in current liability. It is therefore vital for Apple Inc to increase its investment in research and development as it is the primary factor for success for most technology companies. This can make it be ahead of its competitors because it gives it the opportunity to come with a new product with a superior feature. Furthermore, Apple Inc should increase services it provides through third parties in the form of music, e-books and other mobile use should continue as is essential in making the company more popular than other rivals. To increase its sales revenues, it should improve its sales and marketing by advertising its products in different media including local radios and television to reach more people.

References

Williams, R.et al (2008). Financial & Managerial Accounting. McGraw-Hill Irwin. p. 266. ISBN 978-0-07-299650-0.

Houston, J and Eugene F. (2009). Fundamentals of Financial Management. [Cincinnati, Ohio]: South-Western College Pub. p. 90. ISBN 0-324-59771-1.

Weygandt, J. & Kell, W. G. (1996). Accounting Principles (4th ed.). New York, Chichester, Brisbane, Toronto, Singapore: John Wiley & Sons, Inc. p. 800.

Cite this page

Liquidity, Profitability and Solvency Analysis Paper Example. (2022, Jun 16). Retrieved from https://proessays.net/essays/liquidity-profitability-and-solvency-analysis-paper-example

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Research Paper on Manulife Financial

- Research Paper on Cryptocurrency: The Digital Money Revolution of Our Time

- Essay on Managerial & Financial Accounting: Essential for Business Professionals

- Calculating Return on Security Investment (ROSI) - Essay Sample

- Poor Customer Service: A Bank's Bane - Essay Sample

- Essay Example on Clinic's Total Profit Margin & Net Income: $1.5M

- Essay Sample on FASB: Establishing Uniform Accounting Standards Since the 1920s