Introduction

The case presented requires a deep understanding of the financial performance of the different organizations in different industries as well as the match of the various firms provided to their respective sectors by analyzing their financial data. However, the primary objective of the case is to adequately describe the variations in the financials of different organizations across different industries that is, the airline, hospitality, beer, power, pharmaceuticals, computer, retail as well as newspaper. The case was concluded by constructing between two organization and after that, offering a hypothesis on which organization is healthier and which belong to a certain number.

Airlines

For this discussion, I choose to compare two organizations from the airline industry. The first airline is an international airline offering both local and international flights. Additionally, this organization provides the parcel or packages travel as well as airline repairs on top of owning its oil refinery for its jets. However, in the year 2008, this particular airline merged with the largest carrier in the united states.

On the contrary, the other one is an airline that offers a low-cost carrier in the united states. This company operates mostly in America, in addition to providing limited routes to Latina America as well as to the Caribbean. The company primarily operates three different planes and providing the least maintenance coast, which saves on its costs. The company advances by acquiring new aircraft as well as the right to operate other airports. And through these activities makes this particular airline the state leading low-cost carrier.

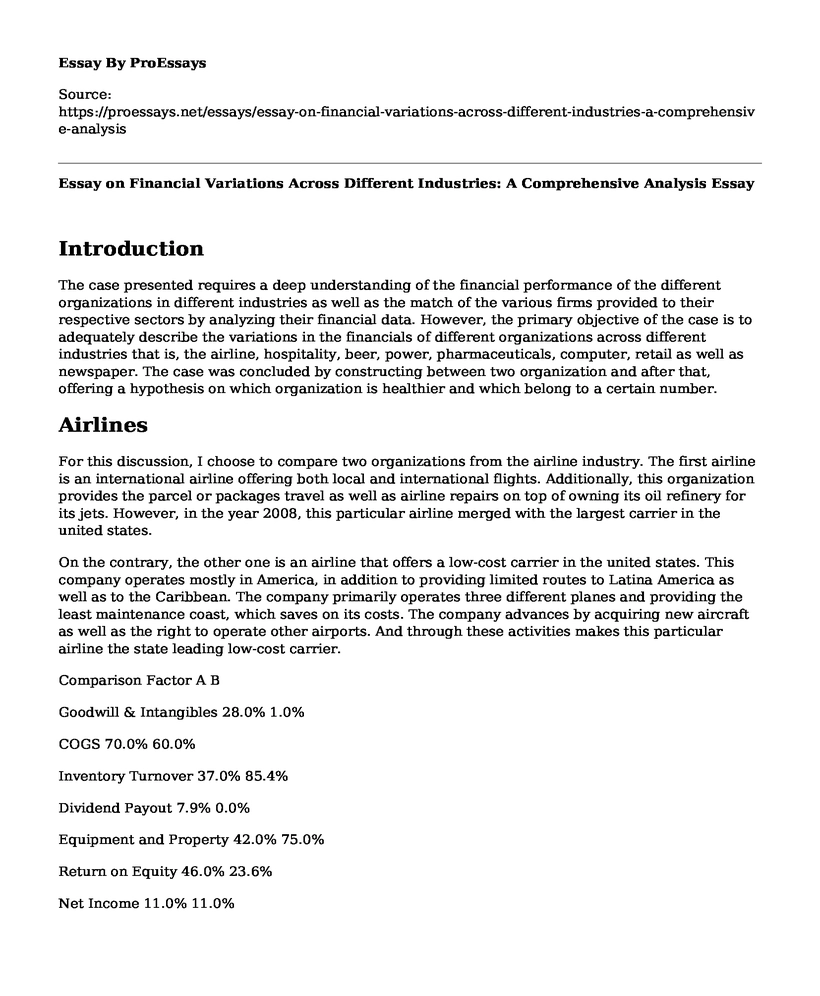

Comparison Factor A B

Goodwill & Intangibles 28.0% 1.0%

COGS 70.0% 60.0%

Inventory Turnover 37.0% 85.4%

Dividend Payout 7.9% 0.0%

Equipment and Property 42.0% 75.0%

Return on Equity 46.0% 23.6%

Net Income 11.0% 11.0%

By making use of the financial information in the table above, I was able to determine that categories in the table were the best in the evaluation process. By assessing the data, I was able to determine that A is the healthiest airline and this makes it the international airline

However, by comparing the cost of goods sold for the two airlines. It can be seen that company A has a higher percentage as compared to that of B, and this led me to conclude that B is the low-cost carrier. This is because the company operates only three aircraft hence making its operation cost lower. Additionally, by assessing the two-organization goodwill as well as the intangible assets, I can determine that A was the company involved in a merger in the year 2008.

Conclusion

In conclusion, many indicators can help determine the healthiness of the organization, and this can help determine the ranking of a firm in the industry. The company's return on equity, its assets, but to determine whether an organization was involved in a merger or an acquisition the goodwill is the best indicator.

Cite this page

Essay on Financial Variations Across Different Industries: A Comprehensive Analysis. (2023, May 23). Retrieved from https://proessays.net/essays/essay-on-financial-variations-across-different-industries-a-comprehensive-analysis

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Arguments for the High Price of Tesla Stock Essay

- Environmental Taxes Essay Example

- Problems Facing the U.S. Immigration System Essay

- External Auditors That Don't Doing Quality Audit Work Articles Review

- How Would You Reform the UK Tax System if You Wished to Increase the Level of Economic Efficiency?

- Elements of Professional Judgment Framework - Essay Sample

- Essay Example on McDonald's: Own Your Own Franchise & Enjoy Global Brand Benefits