Introduction

Canada is one of the nations that provide a favorable investment environment for entrepreneurs. A $354, 347 value of her quarterly GDP per capita, tells of how advantageous it can be investing in Canada. As a US national, and willing to enter the Canadian market, one has to consider a variety of factors. These include government policies, culture, and several economic factors such as inflation. The inflation rates can be high or low, and they influence the prices of goods and services in the market. Checking on the trend of inflation rates over the past few years, therefore, dramatically helps investors to make wise investment decisions. With proper analysis, an investor can build a profitable business based on the lights of the current inflation rates.

Case Analysis

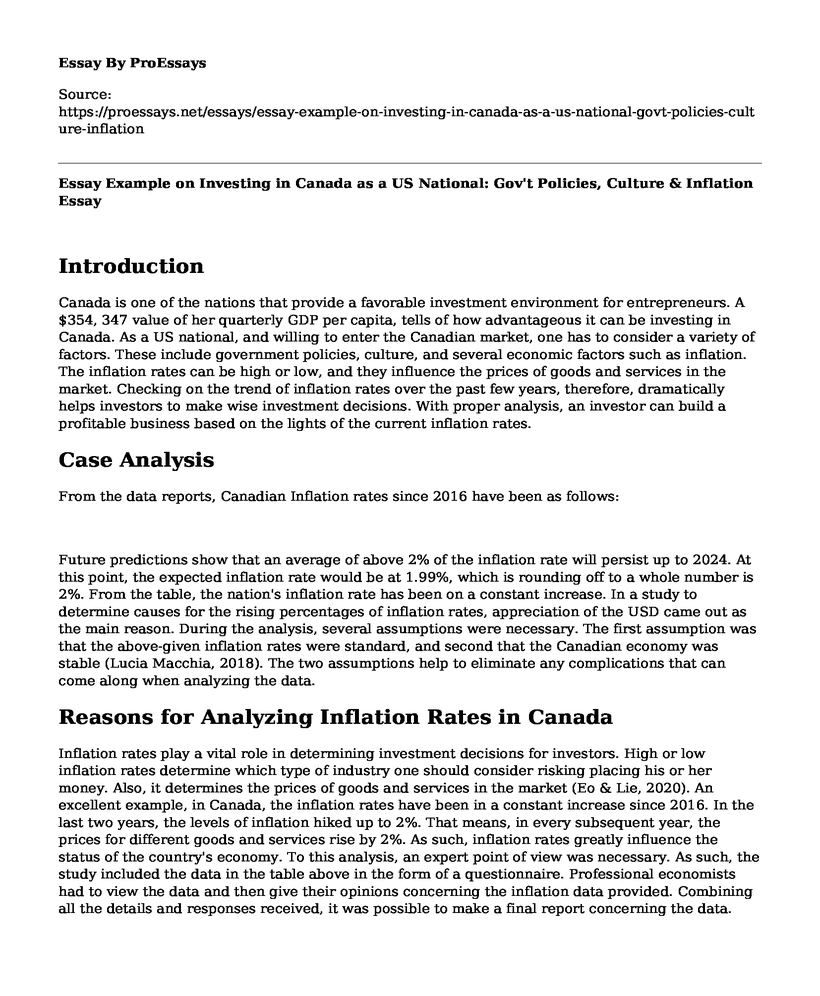

From the data reports, Canadian Inflation rates since 2016 have been as follows:

Future predictions show that an average of above 2% of the inflation rate will persist up to 2024. At this point, the expected inflation rate would be at 1.99%, which is rounding off to a whole number is 2%. From the table, the nation's inflation rate has been on a constant increase. In a study to determine causes for the rising percentages of inflation rates, appreciation of the USD came out as the main reason. During the analysis, several assumptions were necessary. The first assumption was that the above-given inflation rates were standard, and second that the Canadian economy was stable (Lucia Macchia, 2018). The two assumptions help to eliminate any complications that can come along when analyzing the data.

Reasons for Analyzing Inflation Rates in Canada

Inflation rates play a vital role in determining investment decisions for investors. High or low inflation rates determine which type of industry one should consider risking placing his or her money. Also, it determines the prices of goods and services in the market (Eo & Lie, 2020). An excellent example, in Canada, the inflation rates have been in a constant increase since 2016. In the last two years, the levels of inflation hiked up to 2%. That means, in every subsequent year, the prices for different goods and services rise by 2%. As such, inflation rates greatly influence the status of the country's economy. To this analysis, an expert point of view was necessary. As such, the study included the data in the table above in the form of a questionnaire. Professional economists had to view the data and then give their opinions concerning the inflation data provided. Combining all the details and responses received, it was possible to make a final report concerning the data.

Methods of Study in the Case Analysis

For a chance to understand the case in detail, there was a distribution of questionnaires to various economists. The main aim of using questionnaires was to capture explanations on the cause of inflations. The use of surveys was excellent, as polls help to collect both qualitative and quantitative data. Evaluation of the two types of data gives varying findings. Combining the two, therefore, made it possible to come up with an agreeable conclusion (Newton-Levinson, Higdon, Sales, Gaydos, & Rochat, 2020). There was also a direct interview with a few of the economists involved in the study. The study samples included 86 economists, of whom 80 filled the questionnaires while the remaining six responded to a direct interview.

Analysis of Finding

97.7% of the respondents agreed that the appreciation of the USD to Canadian dollar contributed to the rise of the inflation rates. From the report, more than 98% of the economists agreed that there would be a continuous increase in prices for goods and services as the inflation rates continued to rise. As such, there are a variety of possible risks when making investments under high inflation rates. A clear example is when an investor keeps his or her money in long term investments. The respondents also agree that there were numerous opportunities that investors could consider taking with the increasing rates of inflation. One of these is investing in precious commodities (Argyropoulos & Tzavalis, 2018). An excellent example includes precious metals, such as gold. Here, investors hold the actual gold through investments such as ETFs. Gold mining stocks could also be an excellent idea, but in this case, investors don't own the real gold.

The analysis of the respondents' feedback for the data given to them indicated that real estate investment would do great under the current inflation rates. During periods of high inflation rates, investors can make high earnings. For example, during high inflation, the price of rental houses rises. As such, individuals become more willing to buy and buy homes. In doing this, they gain tax benefits, which makes it possible to offset the inflation levels (Argyropoulos & Tzavalis, 2018). Economists recommended that investors who anticipate a rise in inflation levels should have real estate in mind. The analysis suggested that investors should consider individual, commercial, or residential properties. These would be the most profitable with the rising levels of inflation.

The analysis also noted it necessary to consider Money Market Funds. At standard times, money market funds can pay you nothing. That, however, is not the case when there is a possibility of inflation in the future. Note that, increase in inflation rates increases the interest rates. As such, there is an increase in the prices they use to pay for the returns. That would earn an investor great deals. Money market funds do also save investors the loss due to decreased market value (Argyropoulos & Tzavalis, 2018). That is a common problem with the fixed types of investment. During the times of inflation, therefore, money market funds will earn investors the best interest rates. If one fails to take that option, he can also think of the government security bonds. The bonds last for some time, and they operate based on the Consumer Price Index. With high inflation, there will be increased interest rates that, in return, give investors better earning.

Conclusion

From the analysis, it's evident that inflation rates affect a country's economic activities in different ways. One of these is the fact that inflation influences investment decisions for investors. As such, investors have to consider levels of investments before they can invest their cash in any form of business. In Canada, levels of inflations persist in remaining at above 2% in the next three years based on future data predictions. Among the well-known companies that can do best with such levels of investment include real estate and precious metals. One can also consider short term investments and practicing money market trades. These are a few of the businesses that can earn an investor good profits when inflation levels are high.

References

Argyropoulos, E., & Tzavalis, p. E. (2018). The influence of real interest rates and risk premium effects on the ability of the nominal term structure to forecast inflation. The Quarterly Review of Economics and Finance , Available Online.

CentralIntelligenceAgency. (2020, Feb 7). The Would FactBook. Retrieved Feb 18, 2010, from Entral Intelligence Agency: https://www.cia.gov/library/publications/the-world-factbook/geos/ca.html

Eo, Y., & Lie, D. (2020). Average inflation targeting and interest-rate smoothing. Economics Letters , 189, Article 109005.

Lucia Macchia, A. C. (2018). Does experience with high inflation affect intertemporal decision making? Sensitivity to inflation rates in Argentine and british delay discounting choices. Journal of Behavioral and Experimental Economics , 75, 76-83.

Newton-Levinson, A., Higdon, M., Sales, J., Gaydos, L., & Rochat, R. (2020). Context matters: Using mixed methods timelines to provide an accessible and integrated visual for complex program evaluation data. Evaluation and Program Planning , 80, Article 101784.

Cite this page

Essay Example on Investing in Canada as a US National: Gov't Policies, Culture & Inflation. (2023, Apr 08). Retrieved from https://proessays.net/essays/essay-example-on-investing-in-canada-as-a-us-national-govt-policies-culture-inflation

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Multiculturalism in Europe Essay Example

- Corruption Scandal Within Georgia Department of Correction Paper Example

- Ethics and Code of Conduct Essay Example

- Case Analysis Essay on Citizens United vs. FEC: Money in Elections & Democracy

- America: A Superpower With Significant Economic Inequality - Essay Sample

- Migration on the Rise: Seeking a Better Life - Essay Sample

- Essay Sample on China's Religion: Buddhism, Taoism, Islam, and Christianity