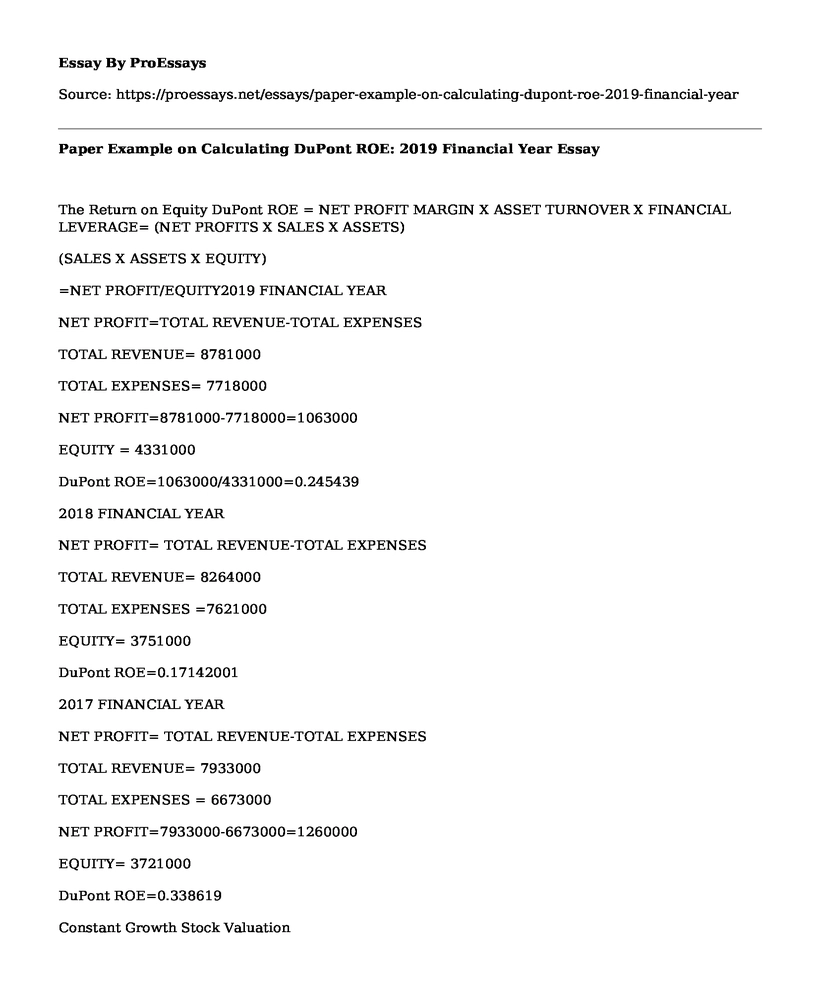

The Return on Equity DuPont ROE = NET PROFIT MARGIN X ASSET TURNOVER X FINANCIAL LEVERAGE= (NET PROFITS X SALES X ASSETS)

(SALES X ASSETS X EQUITY)

=NET PROFIT/EQUITY2019 FINANCIAL YEAR

NET PROFIT=TOTAL REVENUE-TOTAL EXPENSES

TOTAL REVENUE= 8781000

TOTAL EXPENSES= 7718000

NET PROFIT=8781000-7718000=1063000

EQUITY = 4331000

DuPont ROE=1063000/4331000=0.245439

2018 FINANCIAL YEAR

NET PROFIT= TOTAL REVENUE-TOTAL EXPENSES

TOTAL REVENUE= 8264000

TOTAL EXPENSES =7621000

EQUITY= 3751000

DuPont ROE=0.17142001

2017 FINANCIAL YEAR

NET PROFIT= TOTAL REVENUE-TOTAL EXPENSES

TOTAL REVENUE= 7933000

TOTAL EXPENSES = 6673000

NET PROFIT=7933000-6673000=1260000

EQUITY= 3721000

DuPont ROE=0.338619

Constant Growth Stock Valuation

P0= Constant Growth Stock Valuation

P0 =D0(1+g)/ (r-g) (D0= current dividend, g=growth rate in dividends, r=required stock return)

P0= D1/(r-g).

g=(D2/D1)-1

2019 FINANCIAL YEAR

D0= 1.4

g= (6.24/3.55)-1= 0.75774479

r= 6.19

P0= 1.4(1+0.75774479)/(6.19-0.75774479)=

=0.4530057243

2018 FINANCIAL YEAR

D0= 1.28

g= (3.55/8.39) -1= -0.576877r= 3.52

P0=1.28(1+-0.576877)/ (3.52--0.576877)

P0=0.13219763249

2017 FINANCIAL YEAR

D0= 1.2

g= (8.39/ N/A)-1 =N/A

r= 8.35

P0=N/A

Capital constrains

for Alaska Air Group, Inc. (NYS: ALK) to remain competitive in the airline business, it must address its capital limitations to ensure quality customer services and expansion of the company.

Increase Capital

Alaska Air Group should increase its capital base by the sale of more shares in the stock market. With more capital, the company can be able to improve its services and tailor different products as per the customer's requirements. With a huge capital base, the company can also decrease its costs for services to its customers, thereby increasing its customers, and this will make the company competitive and more profitable (Bergbrant, 2018).

Improving terms of outstanding debts

Alaska Air Group should negotiate for improved conditions on paying the debts they currently owe. With enhanced terms, the company can channel more resources used in debt and interest repayment to improve customer satisfaction, thus increasing their marketability. Musa et al. 2018, highlights that the organization's ability to provide quality customers determines its competitiveness. Therefore, for Alaska Air Group to provide these quality services, it must renegotiate terms of debt repayments.

Financial techniques

Cash Flow Analysis

CFA is an economical method that analyzes the cash inflows and cash outflows from a business. This technique will enable Alaska Air Group to monitor its resources and its spendings. Proper monitoring of cashflows ensures that no loss of cash in the process, and the company can re-channel some resources which are not used effectively in different departments (Li et al., 2017).

Ratio Analysis

As Zolfani et al. 2018, affirms ratio analysis will enable the company to make decisions in order of importance; this will allow the company to use the acquired resources from the sale of more shares in the stock market effectively. Ratio analysis prevents misappropriation of resources in companies and ensures that resources channeled to departments will be effectively used (Zolfani et al.).

References

Bergbrant, M. C., Hunter, D. M., & Kelly, P. J. (2018). Rivals' competitive activities, capital constraints, and firm growth. Journal of Banking & Finance, 97, 87-108.

Li, R., Chan, Y. L., Chang, C. T., & Cardenas-Barron, L. E. (2017). Pricing and lot-sizing policies for perishable products with advance-cash-credit payments by a discounted cash flow analysis. International Journal of Production Economics, 193, 578-589.

Musa, O. B., Hassan, R. B. A., Masdan, N. A. E. B., Hasliza, N., & Zahari, B. M. (2018). Modeling the Relationship between its Capability, Organizational Performance, and Customer Satisfaction. INTERNATIONAL JOURNAL OF ACADEMIC RESEARCH IN BUSINESS AND SOCIAL SCIENCES, 8(9), 2051-2064.

Zolfani, S. H., Yazdani, M., & Zavadskas, E. K. (2018). An extended stepwise weight assessment ratio analysis (SWARA) method for improving the criteria prioritizationprocess. Soft Computing, 22(22), 7399-7405.

Cite this page

Paper Example on Calculating DuPont ROE: 2019 Financial Year. (2023, Jul 18). Retrieved from https://proessays.net/essays/paper-example-on-calculating-dupont-roe-2019-financial-year

If you are the original author of this essay and no longer wish to have it published on the ProEssays website, please click below to request its removal:

- Comparative Analysis of Successful Efforts, Full Cost, and IFRS Project

- Liquidity, Profitability and Solvency Analysis Paper Example

- Financial vs. Managerial Accounting Essay

- Advice to Ads Rating for May and June Campaign Letter Paper Example

- Accounting: Organizational Tax and Research Planning Paper Example

- Accounting Disclosures: Financial Policies, Profits & Investors - Essay Sample

- Skimming Pricing Model: Explained by Samsung & Apple